Trudeau is threatening to confiscate bank accounts. Steve Cortez and others has been warning of coming Stagflation. Steve has been a part of Wall Street as a trader and strategist for almost two decades. Others such as Clif High warn of a coming dollar collapse.

Ed Dowd, a former Blackrock Portfolio Manager, reports on Falling Pharma Stocks And Coming Financial Collapse. Edward has said elsewhere how COVID-19 may have been used to cover global debt, and how he predicts a financial collapse is ahead of us.

https://rumble.com/vvc53k-ed-dowd-reports-on-falling-pharma-stocks.html

And now even Tucker Carlson is warning of the problems if the US dollar loses it’s World Reserve Currency status.

On the other hand Edward Harrison, a senior editor at Bloomberg, wrote in 2011 an article On Hyperinflation explaining why the US dollar is still solid because it is the World Reserve Currency. The fly in the ointment is explained in this March, 2013 article, BRICS plan new 50bn bank to rival World Bank and IMF, and The China-Australia Currency Swap Agreement.

… the bilateral currency swap agreement on 22 March 2012. The agreement allows exchange of local currencies between the two central banks…’” thus cutting out the US Dollar as the exchange currency.

The China-Australia Currency Swap Agreement.

Given these circumstances, I thought a discussion about Central Banks and the US dollar was appropriate. I hoped the Q tree could benefit from having this information all in one place.

http://www.silverbearcafe.com/private/06.20/images/servitude.jpg

“Inflation is the surest way to fertilize the rich man’s field with the sweat of the poor man’s brow.”

Charles Holt Carroll (1799-1890.)

Daniel Webster expanded on that idea.

“Of all the contrivances for cheating the laboring classes of mankind, none have been more effectual than that which deludes them with paper money. This is the most effectual of inventions to fertilize the rich man’s field by the sweat of the poor man’s brow. Ordinary tyranny, oppression, excessive taxation — these bear lightly on the happiness of the mass of the community compared with fraudulent currencies and the robberies committed by depreciated paper. Our own history has recorded for our instruction enough, and more than enough, of the demoralizing tendency, the injustice, and the intolerable oppression, on the virtuous and well disposed, of a degraded paper currency, authorized by law, or in any way countenanced by government.”

Daniel Webster (1782 -1852) Statement to the Senate in 1832

With encouragement from Senators Clay and Daniel Webster, Mr Nicholas Biddle, then President of the Second Bank of the United States, applied for a renewal of the Bank’s charter in 1832. President Jackson vetoed the renewal, stating “. . . It appears that more than a fourth part of the stock is held by foreigners and the residue is held by a few hundred of our citizens, chiefly of the richest class. . .” LINK

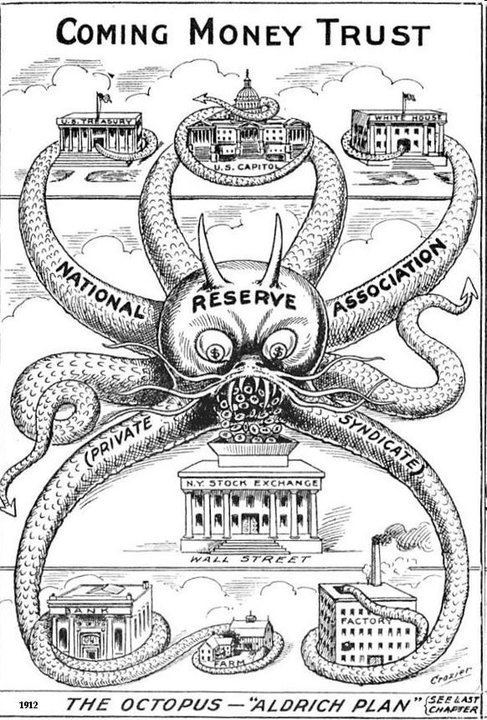

So it should not surprising that Senator Aldrich (R) read that Webster quote at a New York City dinner speech on October 15, 1913 on the eve of the passage of the Federal Reserve Act. He was NOT advocating AGAINST a Fractional Reserve Currency but rather FOR IT! — SEE: aIV Proceedings of the Academy of Political Science #1, at 38 (Columbia University, New York (1914))

For those who might not know the history of Fractional Reserve Banking see: The Magic of Fractional Banking. In essence it is counterfeiting.

https://soundmonetarypolicy.com/wp-content/uploads/2020/03/banksters-11470-20110901-26.jpg

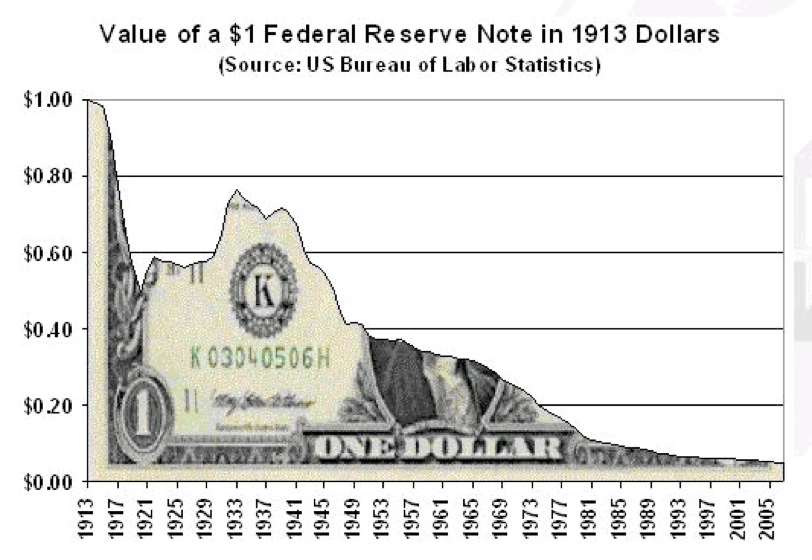

INFLATION or Currency Devaluation:

One of the biggest victories achieved by modern economists and modern central bankers is changing the definition of inflation. Inflation used to mean an increase in the money supply – full stop.

PETER C. SCHMIDT (A very good article)

https://soundmonetarypolicy.com/wp-content/uploads/2020/03/032310Whiskey.jpg

A few more definitions:

Money is metal coins, currency (Bank IOUs) and credit (fairy dust created out of thin air) or even beads and obsidian arrowheads. Money needs to be durable, accepted and dividable which is why precious metals were often the choice.

Money is a generally accepted, recognized, and centralized medium of exchange in an economy that is used to facilitate transactional trade for goods and services.

Investopedia Definition of Money

Wealth is LAND, RESOURCES and the labor that fashions usable and saleable goods.

Wealth is an accumulation of valuable economic resources that can be measured in terms of either real goods or money value.

Investopedia definition of Wealth

Capitalism is a private individual’s wealth, labor and resources reinvested to produce more wealth.

Capitalism is an economic system in which capital goods are owned by private individuals or businesses. The production of goods and services is based on supply and demand in the general market.

@page { size: 8.5in 11in; margin: 0.79in } h2 { margin-top: 0.14in; margin-bottom: 0.08in; background: transparent; page-break-after: avoid } h2.western { font-family: “Liberation Serif”, serif; font-size: 18pt; font-weight: bold } h2.cjk { font-family: “Noto Serif CJK SC”; font-size: 18pt; font-weight: bold } h2.ctl { font-family: “Lohit Devanagari”; font-size: 18pt; font-weight: bold } p { margin-bottom: 0.1in; line-height: 115%; background: transparent } a:link { color: #000080; so-language: zxx; text-decoration: underline }

Investopedia definition of Capitalism

E.M. Smith aka Chiefio, who trained as an economist, gets into the definition of capitalism and other definitions surrounding capitalism: Monopoly, Monopsony, Oligopoly, Collusion And Economics 1 “Evil Socialism” vs “Evil Capitalism” is a short comment by EM describing the continuum between straight capitalism and Communism.

One of the best explanations of the Federal Reserve is by G Edward Griffin. A Talk by G. Edward Griffin-The Creature from Jekyll Island. Unfortunately Griffin is a member of the John Birch Society and is therefore attacked on that basis by the defenders of the Fed. So I am presenting more rigorous sources.

Money Is Created by Banks – Evidence Given by Graham Towers, Governor of the Central Bank of Canada

Some of the most frank evidence on banking practices was given by Graham F. Towers, Governor of the Central Bank of Canada (from 1934 to 1955), before the Canadian Government’s Committee on Banking and Commerce, in 1939… Most of the evidence quoted was the result of interrogation by Mr. “Gerry” McGeer, K.C., a former mayor of Vancouver, who clearly understood the essentials of central banking. Here are a few excerpts:

Q. But there is no question about it that banks create the medium of exchange?

Mr. Towers: That is right. That is what they are for… That is the Banking business, just in the same way that a steel plant makes steel. (p. 287)

The manufacturing process consists of making a pen-and-ink or typewriter entry on a card in a book. That is all. (pp. 76 and 238)

Each and every time a bank makes a loan (or purchases securities), new bank credit is created — new deposits — brand new money. (pp. 113 and 238)

Broadly speaking, all new money comes out of a Bank in the form of loans.

As loans are debts, then under the present system all money is debt. (p. 459)

Q. When $1,000,000 worth of bonds is presented (by the government) to the bank, a million dollars of new money or the equivalent is created?

Mr. Towers: Yes.

Q. Is it a fact that a million dollars of new money is created?

Mr. Towers: That is right.

Q. Now, the same thing holds true when the municipality or the province goes to the bank?

Mr. Towers: Or an individual borrower.

Q. Or when a private person goes to a bank?

Mr. Towers: Yes.

Q. When I borrow $100 from the bank as a private citizen, the bank makes a bookkeeping entry, and there is a $100 increase in the deposits of that bank, in the total deposits of that bank?

Mr. Towers: Yes. (p. 238)

Q. Mr. Towers, when you allow the merchant banking system to issue bank deposits which, with the practice of using the cheques as we have it in vogue today, constitutes the medium of exchange upon which I think 95 per cent of our public and private business is transacted, you virtually allow the banks to issue an effective substitute for money, do you not?

Mr. Towers: The bank deposits are actual money in that sense, yes.

Q. In that sense they are actual money, but, as a matter of fact, they are not actual money but credit, bookkeeping accounts, which are used as a substitute for money?

Mr. Towers: Yes.

Q. Then we authorize the banks to issue a substitute for money?

Mr. Towers: Yes, I think that is a very fair statement of banking. (p. 285)

US banks operate without Reserve

“Banks typically have 3% of their assets in cash in order to meet customer needs. Since 1960, banks have been allowed to use this “vault cash” to satisfy their reserve requirements. Today, bank reserve requirements have fallen to the point where they are now exceeded by vault cash, which means lowering reserve requirements to zero would have virtually no impact on the banking system. US banks are already operating free of any reserve constraints. The graph below shows reserve requirements falling to zero over the last fifty years….”

Eric deCarbonnel

E.M. Smith and other economists, such as Steve Bannon and those he has on the War Room as well as other financial experts are trained (and believe in) Keynesian Economics (IMF.) I prefer Mises and have had arguments with E.M to that effect. (He has started to come around a bit.) It should be noted that Communist spy Harry Dexter White of the US Treasury and Fabian Socialist John Maynard Keyne are the two who saddled the world with the IMF and World Bank via the 1944 Bretton Woods system. I mentioned recently Structural Adjustment Policies, the noose the IMF & World Bank Banksters put around the neck of countries that go bankrupt. There is another Economic Philosophy not connected to the Communists and Fabian Socialists. It was developed by Mises.

Mises on Money by Gary North

This is very long so I want to highlight a few critical points.

#1. Because money is not capital, he [Mises] concluded that an increase of the money supply confers no identifiable social value. If you fail to understand this point, you will not be able to understand the rest of Mises’s theory of money. On this assessment of the value of money, his whole theory of money hinges.

An increase in the quantity of money can no more increase the welfare of the members of a community, than a diminution of it can decrease their welfare. Regarded from this point of view, those goods that are employed as money are indeed what Adam Smith called them, “dead stock, which . . . produces nothing”

#2. New money does not appear magically in equal percentages in all people’s bank accounts or under their mattresses. [New] Money spreads unevenly, and this process has varying effects on individuals, depending on whether they receive early or late access to the new money.

It is these losses of the groups that are the last to be reached by the variation in the value of money which ultimately constitute the source of the profits made by the mine owners and the groups most closely connected with them

[This is a critical point and the reason Bankers can steal our wealth]

This indicates a fundamental aspect of Mises’s monetary theory that is rarely mentioned: the expansion or contraction of money is a zero-sum game. Mises did not use this terminology, but he used the zero-sum concept. Because the free market always maximizes the utility of the existing money supply, changes in the money supply inescapably have the characteristic features of a zero-sum game. Some individuals are made better off by an increase in the money supply; others are made worse off. The existing money is an example of a “fixed pie of social value.” Adding to the money supply does not add to its value.

MISES ON GOLD

…the attempt by modern governments to regulate in any way an international gold standard is always a political ruse to undermine its anti-inflationary bias. “The international gold standard works without any action on the part of governments. It is effective real cooperation of all members of the world-embracing market community. . . . What governments call international monetary cooperation is concerted action for the sake of credit expansion”

“Now, the gold standard is not a game, but a social institution. Its working does not depend on the preparedness of any people to observe arbitrary rules. It is controlled by the operation of inexorable economic law” (p. 462)…..

. . . The role played by ingots in the gold reserves of the banks is a proof that the monetary standard consists in the precious metal, and not in the proclamation of the authorities (p. 67).

In order to effect the acceptance of fiat money or credit money, the State adopts a policy of the abolition of its previous contractual obligations. What was previously a legal right of full convertability into either gold or silver coins is abolished by a new law. The State removes the individual’s legal right to exchange the State’s paper notes for gold or silver coins. It then declares that the new, inconvertible fiat paper money or bank credit money is equal in value to the older redeemable notes, meaning equal to the value of the actual coins previously obtainable through redemption. But the free market determines otherwise. The two forms of money are not equal in value in the judgment of the market’s individual participants. Gresham’s law is still obeyed….

Gresham’s law

The State can set legal prices, meaning exchange ratios, between the various kinds of money. The effects of such fixed exchange rates are identical to the effects of any other kind of price control: gluts and shortages. The artificially overvalued money (glut) replaces the artificially undervalued money (shortage). This cause-and-effect relationship is called Gresham’s law.

MONEY:

Mises therefore defined money as the most marketable commodity. “It is the most marketable good which people accept because they want to offer it in later acts of impersonal exchange” (Human Action, p. 401.).

Money serves as a transmitter of value through time because certain goods serve as media of exchange.

Money transmits value, Mises taught, but money does not measure value. This distinction is fundamental in Mises’s theory of money.

Mises was adamant: there is no measure of economic value.

….Mises concluded that money is neither a consumption good nor a capital good. He argued that production and consumption are possible without money (p. 82). Money facilitates both production and consumption, but it is neither a production good nor a consumption good. Money is therefore a separate analytical category.

“It is illegitimate to compare the part played by money in production with that played by ships and railways. Money is obviously not a ‘commercial tool’ in the same sense as account books, exchange lists, the Stock Exchange, or the credit system”

Because money is not capital, he concluded that an increase of the money supply confers no identifiable social value. If you fail to understand this point, you will not be able to understand the rest of Mises’s theory of money. On this assessment of the value of money, his whole theory of money hinges….

This theory regarding the impact that changes in the money supply have on social value is the basis of everything that follows. Mises offered here a unique assessment of the demand for money. He implied here that an individual’s demand for production goods or consumption goods, when met by increased production, confers an increase in social value or social welfare.

If a producer benefits society by increasing the production of a non-monetary good, later finding a buyer, then society is benefitted because there are at least two winners and no losers.

Therefore, if a producer of gold and a buyer of gold both benefit from an exchange – which they do, or else they would not trade – yet society receives no social benefit, then the analyst has to conclude that some other members of society have been made, or will be made, worse off by the increase in the money supply. This analysis would also apply to decreases in the money supply.

There are two conceptually related issues here: (1) money as a separate analytical category, neither a consumption good nor a production good; (2) changes in the money supply as conveying neither an increase nor decrease in social value.

With that as a background in economics, we look at the Federal Reserve Bank through the eyes of Congressman Wright Patman (D) in 1964 before President Nixon had to close the gold window.

Excerpts from:

A PRIMER ON MONEY

COMMITTEE ON BANKING AND CURRENCY

HOUSE OF REPRESENTATIVES

WRIGHT PATMAN Chairman 1964

Again this is very long, which is why I have posted excerpts. However if you want to understand our Central Banking System this is a very good document to read.

President Lincoln said :

“Money is the creature of law, and the creation of the original issue of money should be maintained as an exclusive monopoly of the National Government. The privilege of creating and issuing money is not only the supreme prerogative of the Government, it is the Government’s greatest opportunity.” [pg 16]

This is very important. Although US citizens can not exchange Federal Reserve notes for treasury gold, official and semi official foreign banks can.

Behind the Federal Reserve notes is the credit of the U.S. Government. If you happen to have a $5, $10, or $20 Federal Reserve note, you will notice across the top of the bill a printed statement of the fact that the US government promises to pay not the Federal Reserve promises to pay. Nevertheless most Americans to do not understand what the US Government promises to pay: American citizens holding these notes cannot demand anything for them except (a) they can be exchanged for other Federal Reserve notes or (b) that they be accepted in payment of taxes and all debts public and private. Certain official or semiofficial foreign banks may exchange any “dollar credits” they may hold-that is, deposits with the commercial banks-for an equal amount of the Treasury’s gold. Americans themselves may not exchange them for gold . [pg 19]

Of the 19 Federal Reserve officials 12 are elected by bankers so HOW the money supply is increase and WHO gets the interest on the US treasury bonds can get very interesting.

The Federal Reserve officials can always decide to create a large portion of any increase in the money supply themselves, though, of course, a larger portion of the supply will always be provided by the private banks under present law. Still the larger portion of Reserve-created money, the more the U.S. Treasury benefits-because all income of the Federal Reserve after expenses reverts to the Treasury. Thus the Treasury receives a good share of the income earned from the Government securities purchased in Reserve money-creating operations.

On the other hand, if the Federal Reserve officials decide that the increase in the money supply they want is all, or substantially all, to be made by the private banks, the private banks acquire and hold more Government securities than in the first case, and the interest payments on these securities go into bank profits. So, whether the Federal Reserve officials decide to favor the U.S. Treasury or the private banks does make a difference-millions of dollars of difference-in the amount of taxes you, I, and all other taxpayers must pay. After all, one of the biggest items of expense of the Federal Government is the interest it must pay on its debt. [pg 36]

[JUMPING FORWARD IN TIME]

“…Although the money in the Federal Reserve is not in anyway “owned” by private banks they get paid interest on it….

In its latest power play, on October 3, 2008, the Fed acquired the ability to pay interest to its member banks on the reserves the banks maintain at the Fed. Reuters reported on October 3:”

“The U.S. Federal Reserve gained a key tactical tool from the $700 billion financial rescue package signed into law on Friday that will help it channel funds into parched credit markets. Tucked into the 451-page bill is a provision that lets the Fed pay interest on the reserves banks are required to hold at the central bank.”

Global Research

[BACK TO WRIGHT PATMAN]

[An incorrect but ] typical explanation runs this way: John Jones deposits $100 in cash with his bank. The bank is required to keep, say, 20 percent of its deposits in reserves, so the bank must deposit $20 of this $100 as reserves, with a Federal Reserve bank. The bank is free to use the other $80, however, to make loans to customers or invest in securities. The expansion of money thus begins. This kind of explanation not only leads to misunderstanding, it also leads to misguided Government policies and rather constant agitation on the part of bankers for other such policies. Many of the smaller bankers who are, on the whole, not as well versed with the mechanics of the money system as they might be, actually believe that they have deposited a portion of their money, or their depositors’ money, with the Federal Reserve. Thus they feel they are being denied the opportunity to make profitable use of this money. Accordingly, there is always agitation to have the Federal Reserve pay the banks interest on this money which they think they have “deposited” with the Federal Reserve.

Furthermore, they are quite certain that the Federal Reserve System has “used” their money to acquire the Government securities which the Federal Reserve may buy in the process of reserve creation. Believing this, the bankers naturally feel that they are entitled to some share of the tremendous profits which the System receives from interest payments on its Government securities. Many bankers know better. The leaders of the bankers’ associations certainly do. But some of these leaders have not hesitated to play on general ignorance and misunderstanding to mobilize the whole banking community behind drives that are nothing but attempts to raid the Public Treasury.

The truth is, however, that the Private banks, collectively, have deposited not a penny of their own funds, or their depositors funds, with the Federal Reserve banks. The impression that they do so arises from the fact that reserves, once created, can be, and are, transferred back and forth from one bank to another, as one bank gains deposits and another loses deposits. [pg 37]Under Secretary of the Treasury Robert V. Roosa, formerly a Vice President of the Federal Reserve Bank of New York, while testifying before the House Committee on Banking and Currency in 1960, described the misconception as follows:

“There is another misconception which occurs much more frequently-that is, the banks think that they give us the reserves on which we operate and that, too, is a misconception. We encounter that frequently, and, as you know, we create those reserves under the authority that has been described here.”The writer [Wright Patman] has had a couple of personal experiences which ‘have provided some amusing confirmation of the fact that the source of bank reserves is not deposits of cash by the member banks with the Federal Reserve banks. having seen reports that the Federal Reserve System had, on a given date, Government securities amounting to a proximately $28 billion, I went on one occasion to the Federal Reserve Bank of New York where these securities are supposed to be housed, and asked if I might be allowed to see them. The officials of this bank said, yes, they would be glad to show them to me; whereupon they opened the vaults and let me look at, and even hold in my hand, the large mound of Government securities which they claimed to have and which, in fact, they did have.

Since I had also seen reports that the member banks of the Federal Reserve System had a certain number of millions of dollars in “cash reserves” on deposit with the Federal Reserve bank, I then asked if I might be allowed to see these cash reserves. This time my question was met with some looks of surprise; the bank officials then patiently explained to me that there were no cash reserves. The cash, in truth, does not exist and never has existed. [pg 38]When the Federal Reserve purchases a $1 million Government bond and gives some bank credit for $1 million in its reserve account, that bank also credits the bond dealer’s checking account with $1 million. I n other words, to acquire $1 million of reserves, the bank also assumes a liability to pay its customers $1 million. If the transactions stopped here, the bank would, of course, come out even, neither gaining anything nor losing anything. But the fact that there is now $1.million more of bank reserves than existed before means that the private banks as a group can create $6 million more money than existed before. In other words, by acquiring this $1 million more in bank reserves, the private banks have the privilege of creating another $6 million of bank deposits, in the process of which they acquire $6 million in interest-bearing securities or loan paper, less an allowance for leakage into the cash (currency) balances of the public. [pg 43]

What amount of Government securities have the private banks acquired with bank-created money?

On January 31, 1964, all commercial banks in this country owned $62.7 billion in U.S. Government securities. The banks have acquired these securities with bank-created money. In other words, the (banks have used the Federal Government’s power to create money without charge to lend $62.7 billion to the Government at interest.

On January 29, 1964, commercial banks had total assets amounting to $304.7 billion, and all of these had been paid for with bank-created money, except $25.4 billion which had been paid for with their stockholders’ capital. In other words, less than 10 percent of the banks’ assets have been acquired with money invested by stockholders in the banks. [pg 46]The make-up of the Federal Reserve Directors changed in favor of the bankers

The Federal Open Market Committee.

There are 19 participants in this powerful body, 7 appointed by the President of the United States and confirmed by the Senate of the United States. Once appointed, however, a man serves for a period of 14 years, and cannot be removed by the President or by any other official body, except for cause. The other 12 men in this select group are elected to their places through the votes of private commercial bankers. there are 12 voting members of the Federal Open Market Committee. The voting members consist of 7 members of the Board of Governors of the Federal Reserve System, plus some 5 of the 12 Federal Reserve bank residents. [pg 65]Because of this, the balance of power over the money supply lay securely, it was thought, with the public side of the System through authority of the Board of Governors. But when the move toward the alternative open-market technique of control was given legislative blessing by Congress in 1933 and 1935 and a full-fledged central bank thereby created the balance shifted radically toward the private, commercial banking side of the System. [pg 72]

.

.

“ownership” of the fed reserve: Confusion due to stock and elected board members:

The position of the Federal Reserve officials thus seems to be clear :

The Federa1 Reserve banks are not owned by the commercial banks. The viewpoint of the individuals quoted above has also been borne out by the presidents of the Federal Reserve banks in hearings before the House Banking and Currency Committee. However, officials of the Federal Reserve banks are sometimes inclined to take the opposite position. [pg 78]

Do bankers believe that they own the Federal Reserve banks.

Yes. [100% of the “stock” is owned by the private banks. Also after instigating “the Accord” It was later revealed by testimony of some of the Federal Reserve officials to committees of Congress that the Open Market Committee had held a meeting on August 18 and decided not only to raise the discount rate, but to “go their own way” on the Government longer term bond rate as well, despite what the President, the Secretary of the Treasury, and the head of the Office of Defense Mobilization might do”….Therefore the Federal Reserve is not answerable to the President or Congress or the electorate, nor even to a government audit or even Congressional funding!]

The original act required that the banks invest 6 percent of their capital stock in the Federal Reserve banks.

Why was the Federal Reserve Act written to require member banks to invest in the so-called stock of the Federal Reserve banks?The framers of the Federal Reserve Act gave many reasons, but the main, reason was this: it was expected that the Federal Reserve would issue money, not mainly against Government securities as is now the practice, but against commercial and industrial loan paper-“eligible paper” as the reader knows.

It was in view of these considerations that Congress, in framing the Federal Reserve Act in 1913, required member banks of the Federal Reserve System to put a certain percentage of their capital into the .’stock” of the Federal Reserve banks; this “stock” was a safeguard against a misuse of the Government’s credit which was being delegated to these banks. The 1013 act placed on the member banks, furthermore, a “double liability” for their “stock” in the Federal Reserve banks. In other words, if a Federal Reserve bank failed, the member banks would lose not only their invested capital, but an equal amount of capital which they would also forfeit. [pg 79]

The 1933 act also prohibited commercial banks from making stock market loans, and investment banks from accepting public deposits. This was an effort to prevent a wave of stock market speculation like that of the twenties by keeping commercial banking and investment banking separate and distinct. [pg 84] [Clinton got rid of that and other limits on the banks.]

What changes were made the Banking Act of 1935?

The Federal Deposit Insurance Corporation was made permanent, and the Board of Governors was given power to change reserve requirements. The act of 1935 had other important revisions :

(1) The Board of Governors of the Federal Reserve System was changed. Membership no longer included the Secretary of the Treasury and the Comptroller of the Currency, and the number of members was cut from nine to seven. The name, the Federal Reserve Board, was changed to the Board of Governors of the Federal Reserve System. The reorganized Board, with its increased powers really gave us a central bank for the first time, in place of a system of individual Federal Reserve banks which were largely on their own.

(2) Also of primary importance in creating a true central bank was the establishment of the Federal Open Market Committee to determine purchases and sales of Government securities for the entire System.

(3) Another change made by the 1935 act related to loans of the Federal Reserve banks. This act allowed the Federal Reserve banks to extend reserve bank credit on any type of credit which the commercial bank possessed.

4 ) The 1935 act also contained provisions concerning regulation of bank holding companies. [Pg 84]Private banks enjoy a very special relationship with the Federal Government. After all, most business firms employ private capital or privately owned resources to produce a product or provide a service which can be profitably sold in the marketplace. Most business firms pay for the raw materials and services they receive, and, furthermore, in the case of most kinds of business firms, the business itself is a risk-taking venture. The firm succeeds or fails in competition with other business firms.

But the conditions under which private banks operate are very different. In the first place, one of the major functions of the private commercial banks is to create money. A large portion of bank profits come from the fact that the banks do create money. And, as we have pointed out, banks create money without cost to themselves, in the process of lending or investing in securities such a Government bonds. Bank profits come from interest on the money lent and invested, while the cost of creating money is negligible. (Banks do incur costs, of course, from bookkeeping to loan officers’ salaries.) The power to create money has been delegated, or loaned, by Congress to the private banks for their free use. There is no charge.

On the contrary, this is but one of the many ways the Government subsidizes the private banking system and protects it from competition. The Government, through the Federal Reserve System, provides a huge subsidy through the free services the System provides for member banks. “Check clearing” is one of the services; i.e., the collection and payment of funds due one bank from another because of depositors’ use of their checkbook money. The costs of this service alone runs into scores of millions of dollars.

The gross expenses of the combined Federal Reserve banks totaled $207 million in 1963, most of which was incurred as a cost of providing free services to the private banks. Other Federal agencies also receive services from the Federal Reserve. But these are not free. The System received about $20 million for “fiscal agency and other expenses” in 1963.In addition, the Federal Government provides private banks with a large measure of protection from competition, and the hazards of failure. … This means, in brief, that nobody can enter the banking business by opening a national bank, unless the proposed bank is to be located where it will not cause an inconvenient amount of competition to other banks already in business. [pg 89]

In mid-August of 1950, however, the Federal Reserve raised the discount rate and short-term Treasury bills jumped toward 11/2 percent, although there were requests from the Secretary of the Treasury and the President for the System to continue a low-rate policy. It was later revealed by testimony of some of the Federal Reserve officials to committees of Congress that the Open Market Committee had held a meeting on August 18 and decided not only t o raise the discount rate, but to “go their own way” on the Government longer term bond rate as well, despite what the President, the Secretary of the Treasury, and the head of the Office of Defense Mobilization might do….

Since the signing of the so-called accord, in March of 1951, this event has been widely interpreted as an understanding, reached between the Treasury and the Federal Reserve, that the Federal Reserve would henceforth be “independent.” It would no longer ” peg Government bond prices. It would raise or lower interest rates as it might see fit, as a means of trying to prevent inflation or deflation.These are understandings which have been grafted onto the accord over the years. Certainly, no such understandings were universal at the time the accord was signed. ….

At the end of 1951, then, the Federal Reserve had both self-proclaimed independence, as a result of the accord, and an operational policy which aimed at maximum credit effects through minimum changes in interest rates….. the Federal Reserve people were quite sure that they could do a better job of running the country than the President, and with only slight increases in interest rates. …

It then added another string to its bow- the “bills only” policy. … Henceforth when the Treasury issued bonds or medium-term securities, it was to dump these issues on the market and watch the natural consequences-first a drop in bond prices, then a gradual recovery as the market absorbed the bonds. Any private rigging or manipulations of the market were to go without interference from the Federal Reserve, as were any speculative booms or panics short of a “disorderly” market. The “bil1s-only” policy had only one reservation: The Federal Reserve would buy long-term bonds in the event that the Open Market Committee made a findings that the market was disorderly. [ full details starting on pg 103]

The [Eisenhower ] administration announced at the outset that it would re1y on monetary policy exclusive1y for its economic regulation and would respect the complete independence of the Federal Reserve to carry out these policies as it saw fit …..

Thirteen years have now passed since the accord and the liberation of the Federal Reserve. What have been the results? The major result is shockingly obvious. Interest rates have climbed steadily, with slight interruptions, during the entire post accord period. (See table 3.) The period has been marked, then, by a continual shift of income to the banks, other major financial institutions, and individuals with significant interest income. The rest of the country provided this income. …

Another result of post accord monetary policy is that the U.S. economy has unwittingly become a low investment economy… The Federal Reserve has chosen the high interest, slower growth option for this country.

In fiscal year 1963, the U S Government paid out approximately $10 billion as interest on the national debt. The budget deficit for the same year was $8.8 billion. Much political hay was made with the deficit. It was potential inflationary dynamite, ran the ”no deficit” claim. And these same people strongly supported tighter money and higher interest rates to prevent the otherwise inevitable inflationary explosion. Yet if these people were really worried about the deficit they should have been rabid partisans of a low-interest policy. For it can be shown that last year’s deficit would have been $5 billion less if the Government had not been forced by Federal Reserve policy to pay increasingly more on its outstanding debt. I n fact, the total national debt would now be $40 billion less if the interest rates of the early 1940’s had prevailed in the postwar period.

Moreover, the system eludes even the audit control exercised by the General Accounting Office, whose function it is to make sure that other Federal agencies not only handle their financial affairs properly but also pursue policies and practices that are in accord with the law. The system provides for its own auditing; clutching its mantle of independence, it has stoutly resisted repeated congressional suggestions that the General Accounting Office perform an annual audit.[ pg 121]

Congress has never given authority for determining monetary policy to the Federal Reserve System-and certainly not to a committee within the System containing members who owe their selection to private bank interests. This basic authorization has not been changed by any amendments to the Federal Reserve Act made to date. Yet two evolutions have taken place within the Federal Reserve System, in one instance, without authorization, and, in the other, directly contrary to the expressed intent of the Federal Reserve Act. In brief, the Federal Reserve’s “monetary policies,” as they are practiced today, were never authorized by law…There is little doubt in the author’s mind that if any legal challenge were ever raised to the Federal Reserve’s monetary policies, the courts could hold them unconstitutional.

The First Annual Report of the Board of Governors after passage of the 1935 act opened with a statement that the act “places responsibility for national monetary and credit on the Board of Governors and the Federal Open Market Committee”-although the act contained no reference whatever to monetary policy nor any provision which indicated a change in the convertibility concept on which the 1913 act was drawn. In brief, the Federal Reserve’s “monetary policies,” as they are practiced today, were never authorized by law.

The monetary powers, as has frequently been pointed out, are reserved to the Congress by the constitution. There is no doubt that it is within the prerogative of the Congress to delegate these powers either to the executive branch of the Government or to an independent agency. But it is not within Congress’s constitutional means to delegate these powers without prescribing policy objectives and clear guidelines detailing how the powers may be used. Inevitably, the Supreme Court has held unconstitutional those grants of powers made without any spelling out of the specific objectives and limitations placed on their use [pg 128]

This second change, whatever else it accomplished, did open the door to private banker influence in the formation of monetary policy. T h e regional bank presidents have become policymakers. At the very least, the type of man chosen to become the president of a regional bank affects the bent of Open Market Committee thinking. Now the private bankers have the dominant voice in choosing the regional bank presidents. They are hardly likely to choose and retain man as presidents whose approach to monetary matters does not in general conform to their taste.

I hope you take the time to read these excerpts and do not blow your blood pressure too high.

“Capitalists with government help are the worst of all economic phenomena.” — A. Rand

Rand was wrong, the absolute worst economic phenomenon is “Capitalists with government help ALL paid for by counterfeit money printed by the Robber Baron Bankers”

The book “Bank Control of Large Corporations in the United States” By David M. Kotz, explains how banks use pension funds to buy controlling interest in large corporations among other strategies.

The study of mathematics is roughly divided into three segments — geometry, algebra, and analysis. A typical college department will be split about 5%, 45%, and 50%, respectively. Generally, they get along, although sitting-in on one another’s classes would cause them to have massive headaches.

Economics is roughly divided into three segments — “classical” economics, Keynesian economics, and “Austrian” economics. A typical college department will be split about 20%, 70%, and 10%, respectively. Unlike math departments, it is not unusual for each faction to hate the other two.

The thing is, just like a situation on the ground might be solved either algebraically or geometrically, it is frequently an advantage to take a couple of different perspectives on the same circumstances and see if they seemingly contradict each other or support the same conclusions, and all three segments of economics are valid ways of looking at things. Until you start poking in the corners, that is….

And, since we’re on the subject of Economics, I have to drag these out….

and

Is everyone seeing two vids? I’m sure I put two in there, but I can only see the first one at present.

Yes, they are both there.

In the first video, you see a classic formula for Gross Domestic Product (GDP) — which, for historical reasons, is designated by the letter Y. It normally looks something like “Y = C + I + G + (Ex – Im)”. To write it out in full, “GDP = Consumption + Investment + Government + (Exports – Imports)”. This is the expenditures approach….”but what”, you may ask, “do expenditures have to do with production?”

Well, there is the original way to look at GDP that involves production, but it’s messy….

….so everyone uses the expenditures approach. Keynesians love it, but Austrians have one word that torpedoes it — and that word is “malinvestment”. That’s when you spend a lot of money to do one thing, but find out you don’t want to do that after the money has been spent. It’s like a developer buying a ginormous pile of fireplace bricks and finding out that people want framed-in gas fireplaces without hearths.

While normally applied to the “Investment” term in the expenditures formula, the concept of “malinvestment” is rife within the “Government” term, as well. Coming from the land of the Bullet Train to Nowhere, I am intimately familiar with large amounts of government expenditure resulting in little-or-no actual production….much less the production of something anyone might actually want.

Further, there is a reference to interest rates being a “gas pedal” to accelerate or slow down an economy (a Keynesian riff)…..where actually interest rates are a blade that separates “smart” from “stupid.” Back in the 80s, when people were interested in running companies profitably and efficiently, there was a thing called the “Internal Rate of Return” or IRR. Projects would get the green-light or quashed based on it. With interest rates held unnaturally low, any damned fool with a money source could look like a genius.

It should also be noted that any public funds siphoned off to grift count as government expenditures, but help nobody but the grifters.

“…and that word is “malinvestment”.

Hubby came back with the Sunk cost fallacy and the Gamblers fallacy.

Sunk cost fallacy = we have put so much in (Money labor or spiritual) and it hasn’t done what we wanted so we have to spend MORE… or in other words when you are in a hole QUIT DIGGING!

Gotta add

The March of History: Mises vs. Marx

The Definitive Capitalism vs. Socialism Rap Battle

Here are the words to the above: https://misesvsmarx.aier.org/

Gail alluded to this, but there have been three national banks of the United States.

The first ran 20 years from 1791 to 1811 and was championed by Alexander Hamilton (which is why he’s on the back of a 10-spot) [ https://www.investopedia.com/first-bank-united-states-5217537 ]. Upon our nation’s founding, its finances were a horrible smoking wreck. Based on the model of the Bank of England, the Bank of the United States helped bridge the gap between the “Continental Dollar” and slightly more stable US currency, but after Aaron Burr killed Hamilton, there was no real voice to call for the renewal of the bank’s 20-year charter.

Immediately after this, however, we had the “War of 1812”, which (again) left the nation’s finances in a shambles. And, immediately after that, we had the formation of the Second Bank of the United States, chartered in 1816.

When the Second Bank of the United States came up to renew its 20-year charter in 1836, President Andrew Jackson vetoed the renewal with a very stirring and truthful speech. Somehow we then managed without a Central Bank until 1913, despite little things like major territorial expansion and a Civil War.

I’m going to reply to myself with Jackson’s Bank Veto speech, but I’ll note that it should be read backwards. Read the final paragraph, then the last two, then the last four. Only then should it be read through.

Incidentally, I couldn’t get a copy through DDG and had to go to Bing.

The bill “to modify and continue” the act entitled “An act to incorporate the subscribers to the Bank of the United States” was presented to me on the 4th July instant. Having considered it with that solemn regard to the principles of the Constitution which the day was calculated to inspire, and come to the conclusion that it ought not to become a law, I herewith return it to the Senate, in which it originated, with my objections.

A bank of the United States is in many respects convenient for the Government and useful to the people. Entertaining this opinion, and deeply impressed with the belief that some of the powers and privileges possessed by the existing bank are unauthorized by the Constitution, subversive of the rights of the States, and dangerous to the liberties of the people, I felt it my duty at an early period of my Administration to call the attention of Congress to the practicability of organizing an institution combining all its advantages and obviating these objections. I sincerely regret that in the act before me I can perceive none of those modifications of the bank charter which are necessary, in my opinion, to make it compatible with justice, with sound policy, or with the Constitution of our country.

The present corporate body, denominated the president, directors, and company of the Bank of the United States, will have existed at the time this act is intended to take effect twenty years. It enjoys an exclusive privilege of banking under the authority of the General Government, a monopoly of its favor and support, and, as a necessary consequence, almost a monopoly of the foreign and domestic exchange. The powers privileges, and favors bestowed upon it in the original charter, by increasing the value of the stock far above its par value, operated as a gratuity of many millions to the stockholders.

An apology may be found for the failure to guard against this result in the consideration that the effect of the original act of incorporation could not be certainly foreseen at the time of its passage. The act before me proposes another gratuity to the holders of the same stock, and in many cases to the same men, of at least seven millions more. This donation finds no apology in any uncertainty as to the effect of the act. On all hands it is conceded that its passage will increase at least 20 or 30 per cent more the market price of the stock, subject to the payment of the annuity of $200,000 per year secured by the act, thus adding in a moment one-fourth to its par value. It is not our own citizens only who are to receive the bounty of our Government. More than eight millions of the stock of this bank are held by foreigners. By this act the American Republic proposes virtually to make them a present of some millions of dollars. For these gratuities to foreigners and to some of our own opulent citizens the act secures no equivalent whatever. They are the certain gains of the present stockholders under the operation of this act, after making full allowance for the payment of the bonus.

Every monopoly and all exclusive privileges are granted at the expense of the public, which ought to receive a fair equivalent. The many millions which this act proposes to bestow on the stockholders of the existing bank must come directly or indirectly out of the earnings of the American people. It is due to them, therefore, if their Government sell monopolies and exclusive privileges, that they should at least exact for them as much as they are worth in open market. The value of the monopoly in this case may be correctly ascertained. The twenty-eight millions of stock would probably be at an advance of 50 per cent, and command in market at least $42,000,000, subject to the payment of the present bonus. The present value of the monopoly, therefore, is $17,000,000, and this the act proposes to sell for three millions, payable in fifteen annual installments of $200,000 each.

It is not conceivable how the present stockholders can have any claim to the special favor of the Government. The present corporation has enjoyed its monopoly during the period stipulated in the original contract. If we must have such a corporation, why should not the Government sell out the whole stock and thus secure to the people the full market value of the privileges granted ? Why should not Congress create and sell twenty-eight millions of stock, incorporating the purchasers with all the powers and privileges secured in this act and putting the premium upon the sales into the Treasury ?

But this act does not permit competition in the purchase of this monopoly. It seems to be predicated on the erroneous idea that the present stockholders have a prescriptive right not only to the favor but to the bounty of Government. It appears that more than a fourth part of the stock is held by foreigners and the residue is held by a few hundred of our own citizens, chiefly of the richest class. For their benefit does this act exclude the whole American people from competition in the purchase of this monopoly and dispose of it for many millions less than it is worth. This seems the less excusable because some of our citizens not now stockholders petitioned that the door of competition might be opened, and offered to take a charter on terms much more favorable to the Government and country.

But this proposition, although made by men whose aggregate wealth is believed to be equal to all the private stock in the existing bank, has been set aside, and the bounty of our Government is proposed to be again bestowed on the few who have been fortunate enough to secure the stock and at this moment wield the power of the existing institution. I can not perceive the justice or policy of this course. If our Government must sell monopolies, it would seem to be its duty to take nothing less than their full value, and if gratuities must be made once in fifteen or twenty years let them not be bestowed on the subjects of a foreign government nor upon a designated and favored class of men in our own country. It is but justice and good policy, as far as the nature of the case will admit, to confine our favors to our own fellow citizens, and let each in his turn enjoy an opportunity to profit by our bounty. In the bearings of the act before me upon these points I find ample reasons why it should not become a law.

It has been urged as an argument in favor of rechartering the present bank that the calling in its loans will produce great embarrassment and distress. The time allowed to close its concerns is ample, and if it has been well managed its pressure will be light, and heavy only in case its management has been bad. If, therefore, it shall produce distress, the fault will be its own, and it would furnish a reason against renewing a power which has been so obviously abused. But will there ever be a time when this reason will be less powerful? To acknowledge its force is to admit that the bank ought to be perpetual, and as a consequence the present stockholders and those inheriting their rights as successors be established a privileged order, clothed both with great political power and enjoying immense pecuniary advantages from their connection with the Government.

The modifications of the existing charter proposed by this act are not such, in my view, as make it consistent with the rights of the States or the liberties of the people. The qualification of the right of the bank to hold real estate, the limitation of its power to establish branches, and the power reserved to Congress to forbid the circulation of small notes are restrictions comparatively of little value or importance. All the objectionable principles of the existing corporation, and most of its odious features, are retained without alleviation.

The fourth section provides “that the notes or bills of the said corporation, although the same be, on the faces thereof, respectively made payable at one place only, shall nevertheless be received by the said corporation at the bank or at any of the offices of discount and deposit thereof if tendered in liquidation or payment of any balance or balances due to said corporation or to such office of discount and deposit from any other incorporated bank.” This provision secures to the State banks a legal privilege in the Bank of the United States which is withheld from all private citizens. If a State bank in Philadelphia owe the Bank of the United States and have notes issued by the St. Louis branch, it can pay the debt with those notes, but if a merchant, mechanic, or other private citizen be in like circumstances he can not by law pay his debt with those notes, but must sell them at a discount or send them to St. Louis to be cashed. This boon conceded to the State banks, though not unjust in itself, is most odious because it does not measure out equal justice to the high and the low, the rich and the poor. To the extent of its practical effect it is a bond of union among the banking establishments of the nation, erecting them into an interest separate from that of the people, and its necessary tendency is to unite the Bank of the United States and the State banks in any measure which may be thought conducive to their common interest.

The ninth section of the act recognizes principles of worse tendency than any provision of the present charter.

It enacts that “the cashier of the bank shall annually report to the Secretary of the Treasury the names of all stockholders who are not resident citizens of the United States, and on the application of the treasurer of any State shall make out and transmit to such treasurer a list of stockholders residing in or citizens of such State, with the amount of stock owned by each.” Although this provision, taken in connection with a decision of the Supreme Court, surrenders, by its silence, the right of the States to tax the banking institutions created by this corporation under the name of branches throughout the Union, it is evidently intended to be construed as a concession of their right to tax that portion of the stock which may be held by their own citizens and residents. In this light, if the act becomes a law, it will be understood by the States, who will probably proceed to levy a tax equal to that paid upon the stock of banks incorporated by themselves. In some States that tax is now 1 per cent, either on the capital or on the shares, and that may be assumed as the amount which all citizen or resident stockholders would be taxed under the operation of this act. As it is only the stock held in the States and not that employed within them which would be subject to taxation, and as the names of foreign stockholders are not to be reported to the treasurers of the States, it is obvious that the stock held by them will be exempt from this burden. Their annual profits will therefore be 1 per cent more than the citizen stockholders, and as the annual dividends of the bank may be safely estimated at 7 per cent, the stock will be worth 10 or 15 per cent more to foreigners than to citizens of the United States. To appreciate the effects which this state of things will produce, we must take a brief review of the operations and present condition of the Bank of the United States.

By documents submitted to Congress at the present session it appears that on the 1st of January, 1832, of the twenty-eight millions of private stock in the corporation, $8,405,500 were held by foreigners, mostly of Great Britain. The amount of stock held in the nine Western and Southwestern States is $140,200, and in the four Southern States is $5,623,100, and in the Middle and Eastern States is about $13,522,000. The profits of the bank in 1831, as shown in a statement to Congress, were about $3,455,598; of this there accrued in the nine Western States about $1,640,048; in the four Southern States about $352,507, and in the Middle and Eastern States about $1,463,041. As little stock is held in the West, it is obvious that the debt of the people in that section to the bank is principally a debt to the Eastern and foreign stockholders; that the interest they pay upon it is carried into the Eastern States and into Europe, and that it is a burden upon their industry and a drain of their currency, which no country can bear without inconvenience and occasional distress. To meet this burden and equalize the exchange operations of the bank, the amount of specie drawn from those States through its branches within the last two years, as shown by its official reports, was about $6,000,000. More than half a million of this amount does not stop in the Eastern States, but passes on to Europe to pay the dividends of the foreign stockholders. In the principle of taxation recognized by this act the Western States find no adequate compensation for this perpetual burden on their industry and drain of their currency. The branch bank at Mobile made last year $95,140, yet under the provisions of this act the State of Alabama can raise no revenue from these profitable operations, because not a share of the stock is held by any of her citizens. Mississippi and Missouri are in the same condition in relation to the branches at Natchez and St. Louis, and such, in a greater or less degree, is the condition of every Western State. The tendency of the plan of taxation which this act proposes will be to place the whole United States in the same relation to foreign countries which the Western States now bear to the Eastern. When by a tax on resident stockholders the stock of this bank is made worth 10 or 15 per cent more to foreigners than to residents, most of it will inevitably leave the country.

Thus will this provision in its practical effect deprive the Eastern as well as the Southern and Western States of the means of raising a revenue from the extension of business and great profits of this institution. It will make the American people debtors to aliens in nearly the whole amount due to this bank, and send across the Atlantic from two to five millions of specie every year to pay the bank dividends.

In another of its bearings this provision is fraught with danger. Of the twenty-five directors of this bank five are chosen by the Government and twenty by the citizen stockholders. From all voice in these elections the foreign stockholders are excluded by the charter. In proportion, therefore, as the stock is transferred to foreign holders the extent of suffrage in the choice of directors is curtailed. Already is almost a third of the stock in foreign hands and not represented in elections. It is constantly passing out of the country, and this act will accelerate its departure. The entire control of the institution would necessarily fall into the hands of a few citizen stockholders, and the ease with which the object would be accomplished would be a temptation to designing men to secure that control in their own hands by monopolizing the remaining stock. There is danger that a president and directors would then be able to elect themselves from year to year, and without responsibility or control manage the whole concerns of the bank during the existence of its charter. It is easy to conceive that great evils to our country and its institutions might flow from such a concentration of power in the hands of a few men irresponsible to the people.

Is there no danger to our liberty and independence in a bank that in its nature has so little to bind it to our country? The president of the bank has told us that most of the State banks exist by its forbearance. Should its influence become concentered, as it may under the operation of such an act as this, in the hands of a self-elected directory whose interests are identified with those of the foreign stockholders, will there not be cause to tremble for the purity of our elections in peace and for the independence of our country in war? Their power would be great whenever they might choose to exert it; but if this monopoly were regularly renewed every fifteen or twenty years on terms proposed by themselves, they might seldom in peace put forth their strength to influence elections or control the affairs of the nation. But if any private citizen or public functionary should interpose to curtail its powers or prevent a renewal of its privileges, it can not be doubted that he would be made to feel its influence.

Should the stock of the bank principally pass into the hands of the subjects of a foreign country, and we should unfortunately become involved in a war with that country, what would be our condition? Of the course which would be pursued by a bank almost wholly owned by the subjects of a foreign power, and managed by those whose interests, if not affections, would run in the same direction there can be no doubt. All its operations within would be in aid of the hostile fleets and armies without. Controlling our currency, receiving our public moneys, and holding thousands of our citizens in dependence, it would be more formidable and dangerous than the naval and military power of the enemy.

If we must have a bank with private stockholders, every consideration of sound policy and every impulse of American feeling admonishes that it should be purely American. Its stockholders should be composed exclusively of our own citizens, who at least ought to be friendly to our Government and willing to support it in times of difficulty and danger. So abundant is domestic capital that competition in subscribing for the stock of local banks has recently led almost to riots. To a bank exclusively of American stockholders, possessing the powers and privileges granted by this act, subscriptions for $200,000,000 could be readily obtained. Instead of sending abroad the stock of the bank in which the Government must deposit its funds and on which it must rely to sustain its credit in times of emergency, it would rather seem to be expedient to prohibit its sale to aliens under penalty of absolute forfeiture.

It is maintained by the advocates of the bank that its constitutionality in all its features ought to be considered as settled by precedent and by the decision of the Supreme Court. To this conclusion I can not assent. Mere precedent is a dangerous source of authority, and should not be regarded as deciding questions of constitutional power except where the acquiescence of the people and the States can be considered as well settled. So far from this being the case on this subject, an argument against the bank might be based on precedent. One Congress, in 1791, decided in favor of a bank; another, in 1811, decided against it. One Congress, in 1815, decided against a bank; another, in 1816, decided in its favor. Prior to the present Congress, therefore, the precedents drawn from that source were equal. If we resort to the States, the expressions of legislative, judicial, and executive opinions against the bank have been probably to those in its favor as 4 to 1. There is nothing in precedent, therefore, which, if its authority were admitted, ought to weigh in favor of the act before me.

If the opinion of the Supreme Court covered the whole ground of this act, it ought not to control the coordinate authorities of this Government. The Congress, the Executive, and the Court must each for itself be guided by its own opinion of the Constitution. Each public officer who takes an oath to support the Constitution swears that he will support it as he understands it, and not as it is understood by others. It is as much the duty of the House of Representatives, of the Senate, and of the President to decide upon the constitutionality of any bill or resolution which may be presented to them for passage or approval as it is of the supreme judges when it may be brought before them for judicial decision. The opinion of the judges has no more authority over Congress than the opinion of Congress has over the judges, and on that point the President is independent of both. The authority of the Supreme Court must not, therefore, be permitted to control the Congress or the Executive when acting in their legislative capacities, but to have only such influence as the force of their reasoning may deserve.

But in the case relied upon the Supreme Court have not decided that all the features of this corporation are compatible with the Constitution. It is true that the court have said that the law incorporating the bank is a constitutional exercise of power by Congress; but taking into view the whole opinion of the court and the reasoning by which they have come to that conclusion, I understand them to have decided that inasmuch as a bank is an appropriate means for carrying into effect the enumerated powers of the General Government, therefore the law incorporating it is in accordance with that provision of the Constitution which declares that Congress shall have power “to make all laws which shall be necessary and proper for carrying those powers into execution.” Having satisfied themselves that the word “necessary” in the Constitution means “needful,” “requisite,” “essential,” “conducive to,” and that “a bank” is a convenient, a useful, and essential instrument in the prosecution of the Government’s “fiscal operations,” they conclude that to “use one must be within the discretion of Congress” and that “the act to incorporate the Bank of the United States is a law made in pursuance of the Constitution” “but,” say they, “where the law is not prohibited and is really calculated to effect any of the objects intrusted to the Government, to undertake here to inquire into the degree of its necessity would be to pass the line which circumscribes the judicial department and to tread on legislative ground.”

The principle here affirmed is that the “degree of its necessity,” involving all the details of a banking institution, is a question exclusively for legislative consideration. A bank is constitutional, but it is the province of the Legislature to determine whether this or that particular power, privilege, or exemption is “necessary and proper” to enable the bank to discharge its duties to the Government, and from their decision there is no appeal to the courts of justice. Under the decision of the Supreme Court, therefore, it is the exclusive province of Congress and the President to decide whether the particular features of this act are necessary and proper in order to enable the bank to perform conveniently and efficiently the public duties assigned to it as a fiscal agent, and therefore constitutional, or unnecessary and improper , and therefore unconstitutional.

Without commenting on the general principle affirmed by the Supreme Court, let us examine the details of this act in accordance with the rule of legislative action which they have laid down. It will be found that many of the powers and privileges conferred on it can not be supposed necessary for the purpose for which it is proposed to be created, and are not, therefore, means necessary to attain the end in view, and consequently not justified by the Constitution.

The original act of incorporation, section 21, enacts “that no other bank shall be established by any future law of the United States during the continuance of the corporation hereby created, for which the faith of the United States is hereby pledged: Provided , Congress may renew existing charters for banks within the District of Columbia not increasing the capital thereof, and may also establish any other bank or banks in said District with capitals not exceeding in the whole $6,000,000 if they shall deem it expedient.” This provision is continued in force by the act before me fifteen years from the 3d of March, 1836.

If Congress possessed the power to establish one bank, they had power to establish more than one if in their opinion two or more banks had been “necessary” to facilitate the execution of the powers delegated to them in the Constitution. If they possessed the power to establish a second bank, it was a power derived from the Constitution to be exercised from time to time, and at any time when the interests of the country or the emergencies of the Government might make it expedient. It was possessed by one Congress as well as another, and by all Congresses alike, and alike at every session. But the Congress of 1816 have taken it away from their successors for twenty years, and the Congress of 1832 proposes to abolish it for fifteen years more. It can not be “necessary” or “proper” for Congress to barter away or divest themselves of any of the powers vested in them by the Constitution to be exercised for the public good. It is not “necessary” to the efficiency of the bank, nor is it “proper” in relation to themselves and their successors. They may properly use the discretion vested in them, but they may not limit the discretion of their successors. This restriction on themselves and grant of a monopoly to the bank is therefore unconstitutional.

In another point of view this provision is a palpable attempt to amend the Constitution by an act of legislation. The Constitution declares that “the Congress shall have power to exercise exclusive legislation in all cases whatsoever” over the District of Columbia. Its constitutional power, therefore, to establish banks in the District of Columbia and increase their capital at will is unlimited and uncontrollable by any other power than that which gave authority to the Constitution. Yet this act declares that Congress shall not increase the capital of existing banks, nor create other banks with capitals exceeding in the whole $6,000,000. The Constitution declares that Congress shall have power to exercise exclusive legislation over this District “in all cases whatsoever,” and this act declares they shall not. Which is the supreme law of the land? This provision can not be “necessary” or “proper” or constitutional unless the absurdity be admitted that whenever it be “necessary and proper” in the opinion of Congress they have a right to barter away one portion of the powers vested in them by the Constitution as a means of executing the rest.

On two subjects only does the Constitution recognize in Congress the power to grant exclusive privileges or monopolies. It declares that “Congress shall have power to promote the progress of science and useful arts by securing for limited times to authors and inventors the exclusive right to their respective writings and discoveries.” Out of this express delegation of power have grown our laws of patents and copyrights. As the Constitution expressly delegates to Congress the power to grant exclusive privileges in these cases as the means of executing the substantive power “to promote the progress of science and useful arts,” it is consistent with the fair rules of construction to conclude that such a power was not intended to be granted as a means of accomplishing any other end. On every other subject which comes within the scope of Congressional power there is an ever-living discretion in the use of proper means, which can not be restricted or abolished without an amendment of the Constitution. Every act of Congress, therefore, which attempts by grants of monopolies or sale of exclusive privileges for a limited time, or a time without limit, to restrict or extinguish its own discretion in the choice of means to execute its delegated powers is equivalent to a legislative amendment of the Constitution, and palpably unconstitutional.

This act authorizes and encourages transfers of its stock to foreigners and grants them an exemption from all State and national taxation. So far from being “necessary and proper” that the bank should possess this power to make it a safe and efficient agent of the Government in its fiscal operations, it is calculated to convert the Bank of the United States into a foreign bank, to impoverish our people in time of peace, to disseminate a foreign influence through every section of the Republic, and in war to endanger our independence.

The several States reserved the power at the formation of the Constitution to regulate and control titles and transfers of real property, and most, if not all, of them have laws disqualifying aliens from acquiring or holding lands within their limits. But this act, in disregard of the undoubted right of the States to prescribe such disqualifications, gives to aliens stockholders in this bank an interest and title, as members of the corporation, to all the real property it may acquire within any of the States of this Union. This privilege granted to aliens is not “necessary” to enable the bank to perform its public duties, nor in any sense “proper,” because it is vitally subversive of the rights of the States.

The Government of the United States have no constitutional power to purchase lands within the States except “for the erection of forts, magazines, arsenals, dockyards, and other needful buildings,” and even for these objects only “by the consent of the legislature of the State in which the same shall be.” By making themselves stockholders in the bank and granting to the corporation the power to purchase lands for other purposes they assume a power not granted in the Constitution and grant to others what they do not themselves possess. It is not necessary to the receiving, safe-keeping, or transmission of the funds of the Government that the bank should possess this power, and it is not proper that Congress should thus enlarge the powers delegated to them in the Constitution.

The old Bank of the United States possessed a capital of only $11,000,000, which was found fully sufficient to enable it with dispatch and safety to perform all the functions required of it by the Government. The capital of the present bank is $35,000,000–at least twenty-four more than experience has proved to be necessary to enable a bank to perform its public functions. The public debt which existed during the period of the old bank and on the establishment of the new has been nearly paid off, and our revenue will soon be reduced. This increase of capital is therefore not for public but for private purposes.

The Government is the only “proper” judge where its agents should reside and keep their offices, because it best knows where their presence will be “necessary.” It can not, therefore, be “necessary” or “proper” to authorize the bank to locate branches where it pleases to perform the public service, without consulting the Government, and contrary to its will. The principle laid down by the Supreme Court concedes than Congress can not establish a bank for purposes of private speculation and gain, but only as a means of executing the delegated powers. of the General Government. By the same principle a branch bank can not constitutionally be established for other than public purposes. The power which this act gives to establish two branches in any State, without the injunction or request of the Government and for other than public purposes, is not “necessary” to the due execution of the powers delegated to Congress.