I AM NOT GOING TO MAKE THIS FANCY. I JUST WANT A PLACE WE CAN PUT ALL THE INFORMATION.

CORBETT REPORT: talks of Bank of England implementing Central Bank Currency and a questionaire designed to show buy in.

WHAT IS THE DELPHI TECHNIQUE? – QUESTIONS FOR CORBETT

Peter writes in to ask how we should respond to the Bank of England’s rigged survey about CBDCs. James answers by describing the Delphi method and how to anti-Delphi in real life.

https://www.bitchute.com/video/cCQeKybJhJq8/

FROM COMMENTS ON MAY 12TH

DO NOT FORGET KLAUS SCHWAB’S THREAT ABOUT CYBER ATTACKS….

The WEF “Cyber Attack” Scenario: Another Crisis “Much Worse than Covid”, Paralysis of Power Supply, Communications, Transportation

WEF: “There will be another crisis. It will be more significant. It will be faster than what we’ve seen with COVID”

TradeBait2(@tradebait2)

Offline

Coyote

Reply to Gail Combs

March 12, 2023 15:39

OK, OK. I get it.

There is no doubt they want us in the digital economy. There is no doubt half the population will never do it without a dictator forcing it. So they are setting up China to be their dictator by killing manufacturing and selling off as many of our strengths as possible. These things we know.

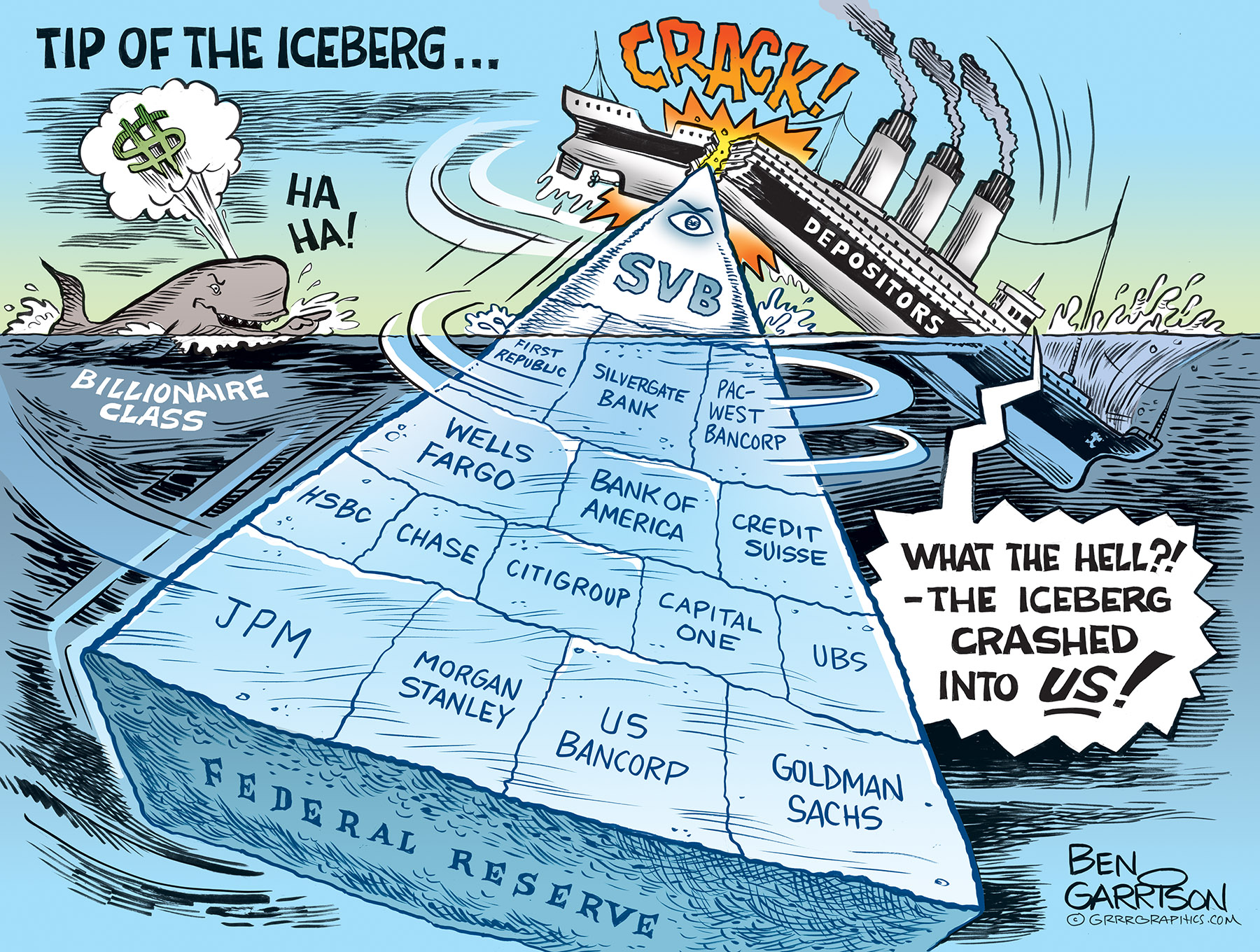

SVB was a creation of the cabal in the 1980s. Its primary purpose of late was to fuel the green economy, venture capital into Silicon Valley tech/research/etc., big Pharm, and other globalist type endeavors. They were the go-to for those industries and it was totally incestuous.

As for today –

First, their investment portfolio is upside down. They have $21 B of treasuries yielding 1.79% when the most recent treasury 10 year issues were at 3.9%. Enter Coothie and others with their “mark to market” accounting discussions. Add in they need to sell some of those assets due to the run. In summary, they take a big hit there.

They had too much liquidity. The Fed has been raising rates, reducing business activity. Less borrowings to earn interest, more payout of interest for higher interest rate deposits that are locked in for at least a year.

Overall economic downturn depressed access to capital for their major customers, which by nature are hard to finance conventional methods. Many would qualify for junk bond status. So those companies, who are depositors in SVB, begin drawing down deposit balances to fund their operations. This adds to SVB’s cash drain.

SVB tries to go to the markets and issue over $2 B in stock to mitigate the damage. That sparks alarm, adds to the run. Buh bye SVB.

Long term –

The major banks, many larger than SVB, are derivative monsters. That exposes them to huge risk in world currency markets as well as interest rate movements if an alternative develops that changes America from being a historical safe harbor for investment and cash. In essence, we have been using our perceived military and economic power to bend over other countries around the world to fuel our spending problem. What happens when there is a more stable alternative? i and others contend that alternative is BRICS with their gold and precious metals standard and mutually accepted currency valuation methods.

If this proceeds as it appears, our larger banks will be in major trouble. The Fed will print more money that we have ever seen. Inflation will explode. Real estate values will tank with a huge rise in defaults. Etc. That will provide the entry the globalists want to force digital currency on a scared population. It will be sold as the patriotic thing to do.

All sponsored by WEF and others in conjunction with BRICS.

Precipice.

𝗟𝗢𝗢𝗞 𝗮𝘁 𝘁𝗵𝗲 𝘀𝗶𝘁𝘂𝗮𝘁𝗶𝗼𝗻 𝗳𝗿𝗼𝗺 𝘁𝗵𝗲 𝗔𝗖𝗧𝗨𝗔𝗟 𝗚𝗢𝗔𝗟 𝗼𝗳 𝘁𝗵𝗲 𝗖𝗔𝗕𝗔𝗟. 𝗧𝗵𝗲𝘆 𝘄𝗮𝗻𝘁 𝗮 𝗱𝗶𝗴𝗶𝘁𝗮𝗹 𝗰𝘂𝗿𝗿𝗲𝗻𝗰𝘆 𝘁𝗶𝗲𝗱 𝘁𝗼 𝗮 𝘀𝗼𝗰𝗶𝗮𝗹 𝗰𝗿𝗲𝗱𝗶𝘁 𝘀𝘆𝘀𝘁𝗲𝗺 𝘀𝘂𝗰𝗵 𝗮𝘀 𝗖𝗵𝗶𝗻𝗮 𝗵𝗮𝘀 𝘀𝗼 𝗯𝗮𝗱 𝘁𝗵𝗮𝘁 𝘁𝗵𝗲𝘆 𝗰𝗮𝗻 𝗧𝗔𝗦𝗧𝗘 𝗜𝗧!

Everything you need to know about Joe Biden’s crypto and digital dollar executive order – Euro News

By

Euronews and Reuters • Updated: 09/03/2022

US president Joe Biden signed an executive order on Wednesday requiring the government to assess the risks and benefits of creating a central bank digital dollar, as well as other cryptocurrency issues, the White House said….

Biden’s order will require the US Treasury Department, the Commerce Department, and other key agencies to prepare reports on “the future of money” and the role cryptocurrencies will play.

Biden is planning a new digital currency. | The Hill

But there is an even more important part of the

EO: President

Biden has instructed the federal government and Federal Reserve to lay the groundwork for a potential new U.S.

currency, a

digital dollar.

Biden announces new Digital Currency… EU Times

President Biden admitted recently that the coming ‘New World Order‘ will soon force a digital currency on everybody which will completely replace the traditional U.S. dollar.

On March 9, the Biden administration released an executive order (EO) instructing a long list of federal agencies to study digital assets and to report back to him about their use and proposals to regulate them.

Much of the executive order is focused on cryptocurrencies such as bitcoin and ethereum, which run on blockchain technology.

But there is an even more sinister aspect of the EO that has been completely ignored by the mainstream media: President Biden has instructed the federal government and Federal Reserve to lay the groundwork for a new U.S. currency, a digital dollar that can be tracked and controlled by the government...

Remember during the Obama years there was a 2 TRILLION DOLLAR UNDERGROUND ECONOMY the Cabal could not track REGULATE OR TAX!

So yes there is an E.O just as General Flynn said.

….

Accidental Banking System Failure? Don’t You Believe It.

By Gregory Mannarino TradersChoice.net

The overnight collapse of SVB, (Silicon Valley Bank), has certainly got everyone’s attention, but is this really any surprise at all?

Absolutely not.

The collapse of SVB is just a symptom of the current worldwide economic freefall being deliberately fostered by central banks.

If you are at all familiar with any of my work or have paid attention to the many articles I have written for the Trends Journal, then you are already keenly aware that right now today

the entire financial system is breaking down… and this is NOT any accident. (We are in the early stages of a deliberate systemic failure).

Today the world economy is in an accelerating freefall, teetering on a knifes edge, being deliberately pushed off the financial cliff by central banks who are collectively attempting to crush the existing system only to issue in a new one.

Roughly 8 months ago, I began to warn those who follow my work on YouTube, (check out my older videos), that the banks are in trouble. It just became too obvious, and the current situation with the banks comes down to just THREE things:

no deposits, no loans, and no deals.

In truth, it’s NOT the banks who are in trouble, but as always-We the People. Just some of the fallout from the SVB collapse is this; depositors with more than the government $250K FDIC insurance will never be made whole, and nor will the shareholders, who were just up until a few days ago being told that everything with the bank was sound. Not to mention the throngs of people who just became unemployed. The greatest threat? The collapse of smaller/regional banks will allow the MEGA banks to consolidate power….

𝗜 𝘀𝘁𝗿𝗼𝗻𝗴𝗹𝘆 𝗿𝗲𝗰𝗼𝗺𝗺𝗲𝗻𝗱 𝘆𝗼𝘂 𝗿𝗲𝗮𝗱 𝘁𝗵𝗲 𝗿𝗲𝘀𝘁 𝗼𝗳 𝘁𝗵𝗶𝘀 𝗮𝗿𝘁𝗶𝗰𝗹𝗲.

….

Looking at some comments from yesterday:

para59r Reply to phoenixrising

March 11, 2023 10:06 … #1064592

Just a thought… not sure if it’s right. Inflation comes about when too much money is chasing too few goods. Fed is currently fighting inflation by raising rates. Everyone is screaming about it. Would this be a back door way of eliminating excess money in the market? The ones currently getting whacked are mostly those with lots of excess cash.

The FED was scheduled to raise rates higher on the 22nd of this month and they have been saying they should of raised rates higher than they did (only .5%) when they last met so this one is expected to at minimum be .75% or maybe a full 1%.

Will be interesting to see where they go next. If they do another .5% would that may be another indicator that this bank failure has been manufactured?

Interesting to see the FED is going to meet out of schedule on Monday.

para59r

March 11, 2023 22:13

#1064946

Up to date talk to include banking situation. His message, don’t fall for it.

Yeah it is a Alex Jones interview but he does mostly shut up.

go from 7 minutes.. (20 minute video)

He covers the WHO taking over health care, nuclear war and then the bank collapse.

@ 15 minutes WAIT on withdrawing funds. The way we BEAT the Cabal is to EXPOSE THEM…

@ 17 minutes their are alreadycorporations and elements of the US government BETA TESTING CENTRAL BANK DIGITAL CURRENCY…

….

What Flynn is saying makes sense.

- Bite-me has signed E.O for transition to digital currency.

- This bank failure, which several people say SHOULD NEVER HAVE HAPPENED, is meant to stampede normies into bank runs.

- Bank runs will be used as an excuse to usher in Digital currency.

I am not really fond of listening to Flynn he is a horrible speaker but this fits the facts.

𝗚𝗲𝗻𝗲𝗿𝗮𝗹 𝗙𝗹𝘆𝗻𝗻 𝗶𝘀 𝘀𝗮𝘆𝗶𝗻𝗴 𝘁𝗵𝗲 𝗚𝗹𝗼𝗯𝗮𝗹𝗶𝘀𝘁𝘀 𝗮𝗿𝗲 𝘁𝗿𝘆𝗶𝗻𝗴 𝘁𝗼 𝗦𝗧𝗔𝗠𝗣𝗘𝗗𝗘 𝗔𝗺𝗲𝗿𝗶𝗰𝗮𝗻𝘀 𝗶𝗻𝘁𝗼 𝗯𝗮𝗻𝗸 𝗿𝘂𝗻𝘀 𝘀𝗼 𝘁𝗵𝗲𝘆 𝗰𝗮𝗻 𝘁𝗵𝗲𝗻 𝗵𝗮𝘃𝗲 𝘁𝗵𝗲 𝗲𝘅𝗰𝘂𝘀𝗲 𝘁𝗼 𝘀𝘄𝗶𝘁𝗰𝗵 𝘂𝘀 𝘁𝗼 𝗗𝗜𝗚𝗜𝗧𝗔𝗟 𝗖𝗨𝗥𝗥𝗘𝗡𝗖𝗬!

….

March 12, 2023 13:50

#1065247

@ 45 minutes the guys DROP A BOMB!

On November 7, 2016, Louise Mensch published this article “EXCLUSIVE: FBI ‘Granted FISA Warrant’ Covering Trump Camp’s Ties To Russia” in Heat Street,

“Two separate sources with links to the counter-intelligence community have confirmed to Heat Street that the FBI sought, and was granted, a FISA court warrant in October, giving counter-intelligence permission to examine the activities of ‘U.S. persons’ in Donald Trump’s campaign with ties to Russia.

Contrary to earlier reporting in the New York Times, which cited FBI sources as saying that the agency did not believe that the private server in Donald Trump’s Trump Tower which was connected to a Russian bank had any nefarious purpose, the FBI’s counter-intelligence arm, sources say, re-drew an earlier FISA court request around possible financial and banking offenses related to the server. The first request, which, sources say, named Trump, was denied back in June, but the second was drawn more narrowly and was granted in October after evidence was presented of a server, possibly related to the Trump

campaign, and its alleged links to the two banks; SVB Bank and Russia’s Alfa Bank. While the Times story speaks of metadata, sources suggest that a FISA warrant was granted to look at the full content of emails and other related documents that may concern US persons.” — Heat Street

They refer to this: Jan 19 2023 Bank of America Customers Report “Disappeared” Money From Accounts

Some Bank of America customers said money is missing from their accounts, including funds from Zelle deposits and transactions.

Rey Garcia has trusted Bank of America with his money for 20 years.

…

“I was surprised, like, whoa,” Garcia said. “So I checked my transactions. I had, like, 15 different Zelle transactions. That was, like, a red flag for me right there because I don’t remember doing all that in one day.”

He says almost $700 went missing from his account. He called customer service with no luck getting a representative.

There’s a Bank of America issue where zelle transfers after 1/9 arent being reflected in the balances of ur bank account. I almost lost my mind when I saw $2,000 was missing from my account. Not accepting calls because of “extenuating circumstances” is insane. CALL ME!!!

…Zelle, a peer-to-peer payment processor that is available through more than 1,700 financial institutions, said that the “issue was not the result of any issues with the Zelle Network.”

“We understand that a Zelle Network financial institution may have experienced issues processing some of their customers’ Zelle transactions, which has now been resolved,” a Zelle spokesperson told FOX Business.

#1065256

Banks Ranked by Derivatives

Rank .. Derivatives ………… Bank Name

1 .. $55,387,209,000,000 .. JPMorgan Chase Bank

2 .. $51,794,949,000,000 .. Goldman Sachs Bank USA

3 .. $46,562,329,000,000 .. Citibank

4 .. $22,087,831,000,000 .. Bank of America

5 .. $12,191,517,000,000 ..Wells Fargo Bank

WELLS FARGO...

Mar 10, 2023

Wells Fargo Says “Technical Issue” Causing Customers to See Missing Deposits in Their Accounts

Wells Fargo on Friday scrambled to respond to customers who reported deposits were missing from their accounts.

Customers complained about missing deposits in their accounts.

Many customers were unable to pay bills or buy groceries.

.

.

Another customer complained about a direct deposit disappearing.

One customer complained about being overdrawn because of missing direct deposits.

Wells Fargo responded: “I understand your concern. If you see incorrect balances or missing transaction, this may be due to a technical issue. We apologize for the inconvenience. Your accounts continue to be secure. We are working quickly on a resolution. -Amanda

Another thing about Wells Fargo.

In that AZ hearing, Remember in the testimony Jacqueline Breger mentionedWELLS FARGO!

Hunter’s Burn Notice: Miami & Houston Edition

…Additionally, Wells Fargo is right next to

Greenberg Traurig LLP, like in one’s backyard. Greenberg was tied to the stock warrants and a blind trust of 22.5% that goes through Continental.

Wells Fargo

was Hunter and Jim Biden’s Bank of choice from the Laptop from Hell….

Failed Silicon Valley Bank Funded Democrats, Establishment RepublicansSVB’s PAC had some eye-opening expenditures.

…FEC filings from 2020 and 2022 show the Silicon Valley Bank PAC, the Super PAC associated with the failed bank, donated in

2020 and

2022 to Political committees directly aligned with Congressional Democrats and pro-impeachment Trump Republicans.

On December 22nd, 2020, well after the 2020 election, Silicon Valley Bank PAC donated to Citizens for Waters, a political committee aligned with Congress Woman Maxine Waters(D-CA). On the same date, Silicon Valley Bank Pac donated to Friends of Gregory Meeks, a political committee aligned with Congressman Gregory Meeks (D-NY). Anthony Gonzales for Congress also received a donation from Silicon Valley Bank Pac on December 22nd, 2020. Anthony Gonzales was among the few Republican Congressmembers to vote to impeach Trump following January 6th….

Interestingly the only political committee Silicon Valley Pac gave to during the 2022 cycle was to friends of Mark Warner. Mark Warner won reelection in 2020 and is not up again until 2026.

Congressional records show that Silicon Valley’s Bank lobbyist in 2022 where the Franklin Square Group, LLC. Franklin Square Group was founded by Josh Ackil, who worked for then-President Bill Clinton. Ackil openly brags about his workings with the Clintons on his Franklin Square Group profile and in media outlets such as the Hill….

Tweet from:

Bill Ackman

The gov’t has about 48 hours to fix a-soon-to-be-irreversible mistake.

By allowing @SVB_Financial to fail without protecting all depositors, the world has woken up to what an uninsured deposit is — an unsecured illiquid claim on a failed bank.

Absent

or

acquiring SVB before the open on Monday, a prospect I believe to be unlikely,

or the gov’t guaranteeing all of SVB’s deposits, the giant sucking sound you will hear will be the withdrawal of substantially all uninsured deposits from all but the ‘systemically important banks’ (SIBs). These funds will be transferred to the SIBs, US Treasury (UST) money market funds and short-term UST. There is already pressure to transfer cash to short-term UST and UST money market accounts due to the substantially higher yields available on risk-free UST vs. bank deposits.

These withdrawals will drain liquidity from community, regional and other banks and begin the destruction of these important institutions. The increased demand for short-term UST will drive short rates lower complicating the

@federalreserve ’s efforts to raise rates to slow the economy.

Already thousands of the fastest growing, most innovative venture-backed companies in the U.S. will begin to fail to make payroll next week. Had the gov’t stepped in on Friday to guarantee SVB’s deposits (in exchange for penny warrants which would have wiped out the substantial majority of its equity value) this could have been avoided and SVB’s 40-year franchise value could have been preserved and transferred to a new owner in exchange for an equity injection. We would have been open to participating.

This approach would have minimized the risk of any gov’t losses, and created the potential for substantial profits from the rescue. Instead, I think it is now unlikely any buyer will emerge to acquire the failed bank. The gov’t’s approach has guaranteed that more risk will be concentrated in the SIBs at the expense of other banks, which itself creates more systemic risk.

For those who make the case that depositors be damned as it would create moral hazard to save them, consider the feasibility of a world where each depositor must do their own credit assessment of the bank they choose to bank with. I am a pretty sophisticated financial analyst and I find most banks to be a black box despite the 1,000s of pages of

@SECGov filings available on each bank.

SVB’s senior management made a basic mistake. They invested short-term deposits in longer-term, fixed-rate assets. Thereafter short-term rates went up and a bank run ensued. Senior management screwed up and they should lose their jobs.

The

@FDICgov and OCC also screwed up. It is their job to monitor our banking system for risk and SVB should have been high on their watch list with more than $200B of assets and $170B of deposits from business borrowers in effectively the same industry.

The FDIC’s and OCC’s failure to do their jobs should not be allowed to cause the destruction of 1,000s of our nation’s highest potential and highest growth businesses (and the resulting losses of 10s of 1,000s of jobs for some of our most talented younger generation) while also permanently impairing our community and regional banks’ access to low-cost deposits. This administration is particularly opposed to concentrations of power. Ironically, its approach to SVB’s failure guarantees duopolistic banking risk concentration in a handful of SIBs. My back-of-the envelope review of SVB’s balance sheet suggests that even in a liquidation, depositors should eventually get back about 98% of their deposits, but eventually is too long when you have payroll to meet next week. So even without assigning any franchise value to SVB, the cost of a gov’t guarantee of SVB deposits would be minimal. On the other hand, the unintended consequences of the gov’t’s failure to guarantee SVB deposits are vast and profound and need to be considered and addressed before Monday. Otherwise, watch out below.

This guy sounds like he knows what he is talking about.

Start at 12 minutes go to around 20 minutes.

Prior to this “TruReporting” mentioned the bank loans were to SOLAR AND WIND. Those are the companies they are talking about. Loans went out no money came back in . (Do not forget all the Biden $$$ for green energy) He seems to thing it might have been a money laundering scam.

He also talks about how it is similar to the 2008 Lehman Brothers scam under Obama.

….

They are mentioning that the companies effected are going to go to Biden for BAILOUTS!

GEE, and Biden JUST HAPPENS TO WANT TO INCREASE THE DEBT CEILING– IMAGINE THAT! (Snarl)

As Wolfie always says

AND LOGIC…

RDS (@guest_1065398)

Online

March 12, 2023 18:18

#1065398

IMO, this guy may have a point —

https://markcrispinmiller.substack.com/p/with-big-banks-cbdcs?utm_source=substack&utm_medium=email

2 hours ago

“With big banks going under, CBDC’s can’t be far behind—and if we don’t STOP them, “lockdown” will be total, and eternal, for us all”

Yours Truly: If one is reading the article correctly, Mr. Miller is of the opinion that since “vaccination” isn’t “working out”, and that the truth is being shown about Jan6, the “Next Big Thing” that will be “deployed” is economic collapse and the imposition of Central Bank Digital Currencies.

RDS (@guest_1065398)

Online

March 12, 2023 18:18

IMO, this guy may have a point —

https://markcrispinmiller.substack.com/p/with-big-banks-cbdcs?utm_source=substack&utm_medium=email

2 hours ago

“With big banks going under, CBDC’s can’t be far behind—and if we don’t STOP them, “lockdown” will be total, and eternal, for us all”

Yours Truly: If one is reading the article correctly, Mr. Miller is of the opinion that since “vaccination” isn’t “working out”, and that the truth is being shown about Jan6, the “Next Big Thing” that will be “deployed” is economic collapse and the imposition of Central Bank Digital Currencies.

I assume that Circle is this company.

https://www.circle.com/en/

Best I can tell they have 9 Billion in assets.

Partnered with Mellon, Black Rock and lessors.

In short.

Circle is a global financial technology firm that’s at the center of digital currency innovation and open financial infrastructure. We bridge the traditional financial system and the world’s leading public blockchains to unlock growth for businesses and investors around the world.

I wonder if they were one of companies that got early warning to pull out?

There is the crypto thing, again.

Crypto is cited in every financial institution going under, recently.

^^^ NOT a coincidence, in my shallow way of thinking. Never trust crypto.

https://media.patriots.win/post/LxstkheNeqDE.jpeg

https://media.patriots.win/post/q2lrDWCiHBFA.png

Arnaud Bertrand – Twitter – Charts at link.

What a chart in the FT: China is now as big as the US and the EU **COMBINED** (!) in terms of manufacturing value added (a measure of the net-output of all manufacturing activity in a country).

Just 15 years ago it was smaller than either one of these 2. Crazy fast change! &

And the craziest part is that its share of world manufacturing increases like this despite shrinking as a share of China’s GDP

In other words, other constituents of China’s GDP (like services) grow even faster than manufacturing. &

And the proportional growth isn’t finished, as the EU’s share is bound to decrease *a lot*

https://s.w.org/images/core/emoji/14.0.0/svg/1f53d.svg, which will increase other countries’ proportionally (and probably China’s disproportionally, since it is the best positioned to capture more manufacturing).

𝗕𝗥𝗘𝗔𝗞𝗜𝗡𝗚: 𝗙𝗲𝗱, 𝗙𝗗𝗜𝗖 𝗗𝗶𝘀𝗰𝘂𝘀𝘀𝗶𝗻𝗴 𝗕𝗮𝗰𝗸𝘀𝘁𝗼𝗽 𝘁𝗼 𝗠𝗮𝗸𝗲 𝗦𝗩𝗕 𝗗𝗲𝗽𝗼𝘀𝗶𝘁𝗼𝗿𝘀 𝗪𝗵𝗼𝗹𝗲 𝗮𝗻𝗱 𝗦𝘁𝗲𝗺 𝗖𝗼𝗻𝘁𝗮𝗴𝗶𝗼𝗻 𝗙𝗲𝗮𝗿𝘀 – 𝗖𝗡𝗕𝗖

3 hr ago

[QUOTE]

The government and their useful idiot secretary of treasury Janet Yellen have just done an about face and are now telegraphing that they will be intervening yet again in “free” markets.

It’s a publicly traded crime scene.… The media wants to make it a crypto story, but it’s not. This is a worldwide money laundering story through these two networks with a crypto wrapper.

—

So why would an illegitimate Federal government, its criminal agencies and the private central banksters at the Fed provide the optics of yet another (quasi) bailout of a bank that failed due in no small part to the very conditions that these central planners caused with their unhinged policies in the first place?

Bailing out SVB will be a drop in the bucket fiat-wise compared to the orgy of money printing that went down during the scamdemic.

Between banks and centralized crypto corporations simultaneously failing, the narrative options for collapse are more than sufficient.

There are many other banks like SVB that are in long-duration securities and have irresponsible and dangerous exposure to treasuries and other bonds. Short sellers started circling these institutions weeks ago, and more will pile in betting against these insolvent banks.

Here is how this may end up playing out:

- The bailout is a headfake

- When other banks start failing over the coming weeks the government apparatchiks like Yellen will claim that they did their best by backstopping SVB while the systemic contagion worsens all around

- By bailing out SVB they are providing the requisite narrative to cover their asses when their masters pull plug on the entire global financial system

- SBV may be used as the “Black Swan” excuse for their PSYOP-MARKET-CRASH, and they can once again claim that they did their utmost (e.g. “The banking system is contained” a la Ben Bernanke’s “Subprime is contained”), but in the end oops sorry the cascading bankruptcies and bank runs were too much for the government to handle

- Pain and fear from frozen bank accounts, food insecurity, inflation, etc. is the perfect means of herding people into the social credit score system of CBDC’s, UBI, never-ending DEATHVAX™ boosters, climate lockdowns, 15 minute cities, etc. & etc.

This is all by design.

Meanwhile, depositors have already begun to panic:

.

.

[UNQUOTE]

kalbokalbs(@kalbokalbs)

Offline

Coyote

Reply to RDS

March 12, 2023 19:41

Still listening to one of the video’s. Corbett. Lots a nuggets.

CBDC – A digitl concentration Camp.

CBDC – When the government TRIES to INSTALL CBDC, I expect:

- 100% CALL TO A GENERAL STRIKE – Shut The Country Down.

- Americans of ALL types will say, FUCK NO.

- ALL 50 States, 50 State Capitals, large cities, small cities…

- Rich, poor, across all blue collar, white collar, retired…

- Gotta believe there will be Widespread, Massive, HELL NO To CBDC.

YES, Coviciocy / Covidiot Injections are being exposed / failing. The J6 narrative LIES are being exposed.

CBDCs will be, ARE a bridge to far. Vast Majority of Americans WILL rise up against CBDC, once they learn, CBDC – Are A Digital Concentration Camp.

Or so I believe.

phoenixrising(@phoenixrising)

Offline

Wolverine

March 12, 2023 21:01

Okay, I guess I skipped over zerohedge’s piece on the Fed’s Statement … that was a mistake!

lookie here:

“The Fed also said that it is prepared to address any liquidity pressures that may arise, which in turn has just unveiled the first bailout acronym of the new crisis: the Bank Term Funding Program, or BTFP. Some more details:

The financing will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par.

The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

The Fed explains that the Department of the Treasury will make available “up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP.” And while the Federal Reserve – which was completely clueless about this banking crisis until Thursday – does not anticipate that it will be necessary to draw on these backstop funds, we anticipate that the final number of needed backstop liquidity be somewhere north of $2 trillion.

What is more notable is that the BTFP – or Buy The Fucking Pivot – facility, will pledge collateral at par, not at market value, thus giving banks credit for all those hundreds of billions in unrealized net losses, and allowing banks to “unlock liquidity” based on losses which the Fed and TSY now backstop!

full article here https://www.zerohedge.com/markets/svb-latest-developments-live-blog-fdic-auction-failed-svb-assets-underway

Brave and Free (@guest_1065461)

Offline

March 12, 2023 20:38

Depositors won’t lose any $$

https://www.federalreserve.gov/newsevents/pressreleases/monetary20230312b.htm

No $$ lost except

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Coothie

It’s still short of The Iceland Plan if former management is still walking around….

Management gets bonuses AND an opportunity to buy SVB stock, BELOW market.

phoenixrising

pennies on the $ — JP Morgan and Jamie Daimon just got richer!

https://www.zerohedge.com/markets/bitcoin-bullion-surge-after-fed-bailout-rate-hike-odds-plummet

US Financial Regulators shut down Signature Bank

https://www.cnbc.com/2023/03/12/regulators-close-new-yorks-signature-bank-citing-systemic-risk.html

click link for statement in image form https://t.me/intelslava/45751

Fed just bailed out SVB depositors while Yellen is saying there’s no bailouts. There it is.

““These banks are badly run because everybody is focused on diversity and all of the woke issues and not concentrating on the one thing they should, which is shareholder returns,” ~ Home Depot Founder https://www.zerohedge.com/political/home-depot-founder-tells-americans-wake-after-silicon-valley-bank-collapse

The Banking Crisis is Global – Not Confined to the USA

https://www.armstrongeconomics.com/world-news/banking-crisis/the-banking-crisis-is-global-not-confined-to-the-usa/

The Unfolding Bank Crisis

https://www.armstrongeconomics.com/world-news/banking-crisis/the-unfolding-bank-crisis/

The Metals Are Not Manipulated

https://www.armstrongeconomics.com/markets-by-sector/precious-metals/gold/the-metals-are-not-manipulated/

C-Level Executives Sold Shares Weeks Before SVB Failed

https://www.armstrongeconomics.com/world-news/corruption/c-level-executives-sold-shares-weeks-before-svb-failed/

michaelh also said in the daily:

And I will add:

Clinton bank laws that created the 2008 Foreclosuregate

The critical part of the scam was the Commodity Futures Modernization Act. This allowed CDSs to be placed on mortgages. If a bank has a couple of CDSs on your mortgage then the bank WANTS to force you into foreclosure See: How the AIG Bailout Could be Driving More Foreclosures

…..

AIG and the Big Takeover: Matt Taibbi on “How Wall Street Insiders Are Using the Bailout to Stage a Revolution”

(And yeah, this is why I was happy to see Matt as a Twatter file journalist.)

Here are the other laws that were removed by Clinton laws to set up the AIG Bailout – Foreclosuregate:

(I rearranged the order and added comments)

The McFadden Act of 1927 or Amendment to the National Banking Laws and the Federal Reserve Act (P.L. 69-639, 44 STAT. 1224): Prohibited interstate banking.

[Clinton’s Law: Negating above:]

Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 (P.L. 103-328, 108 STAT. 2338).

Permits bank holding companies to acquire banks in any state, Beginning June 1, 1997, allows interstate mergers.

The Glass-Steagall Act or Banking Act of 1933 (P.L. 73-66, 48 STAT. 162):

Separated commercial banking from investment banking, establishing them as separate lines of commerce.

Bank Holding Company Act of 1956 (P.L. 84-511, 70 STAT. 133): Prohibited bank holding companies headquartered in one state from acquiring a bank in another state.

[Clinton’s Law: Negating both of the above laws:]

Gramm-Leach-Bliley Act of 1999 (P.L. 106-102, 113 STAT 1338)

(pdf version from Government Printing Office.)

Allows national banks to underwrite municipal bonds.

Amends the Community Reinvestment Act to require that financial holding companies can not be formed before their insured depository institutions receive and maintain a satisfactory CRA rating.

Makes significant changes in the operation of the Federal Home Loan Bank System, easing membership requirements and loosening restrictions on the use of FHLB funds.”

REFERENCE: http://www.fdic.gov/regulations/laws/important/

……………

This one from Zero Hedge is really good:

U.S. ‘Justice’ Department Proclaims Big Banks Have A License To Steal

And WHO is the US Attorney General? — Loretta E. Lynch — a commenter tells us:

I can not find the article referred to (Maybe this? (LINK) but there is this:

http://www.cnn.com/2014/11/19/us/loretta-lynch-fast-facts/

This is what Ted Turner’s CNN left out of the Timeline…. Interesting.

Federal Reserve Bank of New York:

The Board of Governors also appointed LORETTA E. LYNCH, Partner, Hogan & Hartson L.L.P., New York, N.Y., a class C director of this Bank for a three-year term beginning January 2003.

This is amusing —- I couldn’t find a darn thing about Lynch’s bankster connection in the US MSM I have to go to aljazeera.

http://america.aljazeera.com/opinions/2015/6/fifa-indictments-reveal-loretta-lynchs-hypocrisy.html

And do not forget Clinton’s fingerprints all over the 2008 foreclosure mess.

Clinton appointed Lynch to the U.S. Attorney’s office in the Eastern District of New York straight from law firm Cahill, Gordon & Reindel — “the go-to law firm for New York’s financial crooks.” founded just after the Federal Reserve Act was signed.

Lordy you can’t make this stuff up! A publisher of fiction would say it was too unbelievable!

Sometimes, Correlation Is Causation

And YEAH, the Clintons & Banksters OWN Lynch.

𝗧𝗛𝗔𝗧 𝗜𝗦 𝗪𝗛𝗬 𝗣𝗢𝗧𝗨𝗦 𝗧𝗥𝗨𝗠𝗣 𝗛𝗔𝗗 𝗧𝗢 𝗚𝗢 ‼ 𝗧𝗛𝗘𝗬 𝗛𝗔𝗗 𝗧𝗢 𝗛𝗔𝗩𝗘 𝗔𝗡 𝗗𝗢𝗝 𝗧𝗛𝗔𝗧 𝗪𝗢𝗨𝗟𝗗 𝗡𝗢𝗧 𝗝𝗔𝗜𝗟 𝗧𝗛𝗘 𝗕𝗔𝗡𝗞𝗦𝗧𝗘𝗥𝗦 ‼ ‼

That is it Trump was in the way and it needet a hard Ass as President 🙂

I wish so much people would understand all the attracts he went through all 4 years and then they topped it off with Covid and the cherry was Jan6. Memories seem to fade for many and I pray more people will realize what is done to our country what has been done to Trump and still is fabricated. Stay strong God is with us 🙂

old comment from wheatietoo (I miss her 😰 )

May 11, 2019 at 02:28

^^^ This.

Miss her. The comments are correct and will be supported by my business banking career’s work in BIMD as we continue on.

Be sure and read my next story concerning autopsies to gain more understanding of the underlying banking industry.

Armstrong confuses/conflates ‘global’ with The West …

RoW doesn’t have a Fed Res group of ‘Bankstas’

No … the crisis is with banks in the West …

DARN! I wish I could put this as the article header! H/T thesetruths

Ben Garrison:

Traces of Nietzsche’s ideas are made manifest in intersectionality.

.

Nietzsche in the Shadows – The American Spectator | USA News and Politics

Biden says ‘US banking is safe’ as shares plummet up to 74% in pre-market trading despite president’s guarantee scheme for SVB and Signature Bank – amid fears of a rout when stock market opens at 9.30am.

Biden says ‘US banking is safe’ as shares plummet up to 74% in pre-market trading | Daily Mail Online

just believe…

👍 🤣

https://www.zerohedge.com/markets/small-banks-are-crashing

TRUMP:

Based on what’s happening to our economy, and with proposals for the biggest, dumbest tax hike in US history, fivefold, Joe Biden is going to be the Herbert Hoover of the modern era. We will have a Great Depression, much worse than in 1929. In proof of my words, the banks have already begun to fail.

https://t.me/sv_lavrov/6510

https://www.zerohedge.com/markets/watch-live-president-biden-explains-resilience-us-banking-system

I have a dumb question.

Are credit unions, big and small, in as much trouble?

Not necessarily as they are member driven non-profits. They are not participants in commercial lending and investment banking. If they are capitalized well, they tend to motor right through bad economic conditions.

and what about bail-ins occurring in the credit unions ?

more…or less…likely to happen ?

Credit unions typically do not have much in the way of creditors as they are designed to just cover operational expenses and have less bricks and mortar. They are limited in what services they can provide customers. Since they have narrow margins and have no shareholders, they have lower operating expenses and technology. They pass the benefit on to depositors in terms of higher interest rates.

Once they lose their way, the following happens.

https://ncua.gov/support-services/conservatorships-liquidations

I’ve personally never witnessed one be liquidated although I am sure it probably happens. I have seen a couple go into conservatorship and others be merged into another CU. If liquidated they find other CU’s for the deposit accounts and sell the loans at a discount to buyers. The other assets such as real estate, equipment, etc. would also be sold and applied toward debts.

Ok. Even as they provide auto or personal loans?

A lot of times they sell the loans and retain the handling.

I see. Ok.

So what if I financed my house or car through Dodgy Savings And Loan and it goes under? Who do I owe money to then?

Repeat the question, except it’s Dodgy Federal Credit Union.

If you financed your car through Dodgy Savings And Loan, and they sold the loan to Moneybags Bank while retaining servicing rights, you’d continue to pay Dodgy and they’d pay Moneybags. If Dodgy abruptly goes foom, they might try to collect the next payment from you and pocket it, but eventually Moneybags will send you a letter saying that their new servicing agent is Scurvy Bank and you should send your payments to them. Scurvy will step in and perform the same tasks as Dodgy did.

Not a lot changes if Dodgy is an FCU.

I mentioned yesterday that raising interest rates increases inflation

BUT helps the RESERVE Dollar …

The FED is doing this to save Hegemony …

——————————-

via ZeroHedge

Save The Dollar Or The Financial System – Not Both

Via Greg Hunter’s USAWatchdog.com,

https://www.theqtree.com/2023/03/13/dear-kmag-20230313-joe-biden-didnt-win-%e2%9d%80-open-topic/#comment-1065812

This. ^^^

Sorry, No Empathy, No Bailouts And YES I MEAN IT in [Market-Ticker]

Horrible!

California wine industry faces financial crisis majority of vineyards locked out of their accounts | Daily Mail Online

and just when we stupidly thought things couldn’t get….

All im asking is that newsom and Pelosi wineries are in that list.

GOLD Soars 2% on Failure of Fed & Bank Regs

and natural gas futures up 6%.

link to blog post, here..

https://confoundedinterest.net/2023/03/13/gold-soars-2-on-failure-of-fed-and-bank-regulators/

Was the Silicon Valley Bank Collapse Caused by Climate Activism? | Watts Up With That?

Badlands News Brief – by Burning Bright – Badlands Media (substack.com)

AbsoluteTruth1776 offers little to support his opinion, however, it is an opinion I share.

If you were PDT and the white hats, how would you best attack the underlying financial system that is a tool of those who are trying to first, destroy and second, take over the world? Begin taking down their operatives such as SVB.

The current situation has George Soros written all over it. However, the flaw is they cannot allow their system to completely crater or there will be nothing to steal, rape and pillage. Having 100% of nothing is still nothing. Add to it, they are still going to Hell by their own hands and desires.

Collapsing the entire system works against them. BRICS has left their clutches – so there goes half the pie. The sanctions on Russia are only hurting us, the cabal’s collaborators and our legit allies. They are making it easier for powerful countries economically and militarily to walk away while designing their BRICS system to take us down.

By using existing law the Fed can be bankrupted and its useful functions shifted to the Treasury. 1913 can be wiped from the face of our country’s history in short order. It will take going to the precipice to get most Americans’ attention.

the $620 billion hole…

article link..

https://12ft.io/proxy?q=https%3A%2F%2Fwww.washingtonexaminer.com%2Fpolicy%2Feconomy%2Fsilicon-valley-bank-collapse-spotlight-620-billion-hole

open the windows

watch em all jump

^^^ This.

Love it.

You continue to amaze, Gail. What a treasure to all of us. Thank you.

Red Flag category…

☠ 🚩

Smack dab in the middle of housing bubble. Pretty much created it by forcing banks to to take all those sub prime loans.

Great catch! One of the architects of the debt market collapse in 2008. Fannie and Freddie’s boy toy. Dodd-Frank. A facilitator of sub prime mortgages. Using CRA, pushed lenders into thug life areas under threat of redlining laws.

None of this shiz is by accident. Intentional feature.

absolutely intentional

just like the train derailment burn

Saw that bawnee fwank was involved and he takes zero responsibility of course.

https://www.zerohedge.com/markets/its-not-just-failing-banks-here-are-weeks-key-events-cpi-ppi-retail-sales-and-ecb-hike

https://wolfstreet.com/

Looks like this is spreading. Signature Bank was also closed by the FDIC this weekend, and now it looks like 30 banks are in trouble.

Saw that on the main page and figured I check first before asking ya to put here. Not a small deal.

Thank you … trying to do too many things at once … eat, which I sometimes forget to do, look, read and post two places… 😉 Need all the help I can get Para … 3 more to bring over

Tanka Dahal – Twitter

Now over 100 trading halts.

https://www.nasdaqtrader.com/trader.aspx?id=tradehalts

—————————————————–

What is happening is NOT global – but US and UK

—————————————————–

via Michael Hudson

“The collapses of Silvergate and Silicon Valley Bank are like icebergs calving off from the Antarctic glacier. The financial analogy to the global warming causing this collapse is the rising temperature of interest rates, which spiked last Thursday and Friday to close at 4.60 percent for the U.S. Treasury’s two-year bonds. Bank depositors meanwhile were still being paid only 0.2 percent on their deposits. That has led to a steady withdrawal of funds from banks – and a corresponding decline in commercial bank balances with the Federal Reserve.

Most media reports reflect a prayer that the bank runs will be localized, as if there is no context or environmental cause. There is general embarrassment to explain how the breakup of banks that is now gaining momentum is the result of the way that the Obama Administration bailed out the banks in 2008. Fifteen years of Quantitative Easing has re-inflated prices for packaged bank mortgages – and with them, housing prices, stock and bond prices.

The Fed’s $9 trillion of QE (not counted as part of the budget deficit) fueled an asset-price inflation that made trillions of dollars for holders of financial assets, with a generous spillover effect for the remaining members of the top Ten Percent. The cost of home ownership soared by capitalizing mortgages at falling interest rates into more highly debt-leveraged property. The U.S. economy experienced the largest bond-market boom in history as interest rates fell below 1 percent. The economy polarized between the creditor positive-net-worth class and the rest of the economy – whose analogy to environmental pollution and global warming was debt pollution.

But in serving the banks and the financial ownership class, the Fed painted itself into a corner: What would happen if and when interest rates finally rose?

In Killing the Host I wrote about what seemed obvious enough. Rising interest rates cause the prices of bonds already issued to fall – along with real estate and stock prices. That is what has been happening under the Fed’s fight against “inflation,” its euphemism for opposing rising employment and wage levels. Prices are plunging for bonds, and also for the capitalized value of packaged mortgages and other securities in which banks hold their assets on their balance sheet to back their deposits.

The result threatens to push down bank assets below their deposit liabilities, wiping out their net worth – their stockholder equity. This is what was threatened in 2008. It is what occurred in a more extreme way with S&Ls and savings banks in the 1980s, leading to their demise. These “financial intermediaries” did not create credit as commercial banks can do, but lent deposits out in the form of long-term mortgages at fixed interest rates, often for 30 years. But in the wake of the Volcker spike in interest rates that inaugurated the 1980s, the overall level of interest rates remained higher than the interest rates that S&Ls and savings banks were receiving.

Depositors began to withdraw their money to get higher returns elsewhere, because S&Ls and savings banks could not pay their depositors higher rates out of the revenue coming in from their mortgages fixed at lower rates. So even without fraud Keating-style, the mismatch between short-term liabilities and long-term interest rates ended their business plan.

The S&Ls owed money to depositors short-term, but were locked into long-term assets at falling prices. Of course, S&L mortgages were much longer-term than was the case for commercial banks. But the effect of rising interest rates has the same effect on bank assets that it has on all financial assets. Just as the QE interest-rate decline aimed to bolster the banks, its reversal today must have the opposite effect. And if banks have made bad derivatives trades, they’re in trouble.

Any bank has a problem of keeping its asset valuations higher than its deposit liabilities. When the Fed raises interest rates sharply enough to crash bond prices, the banking system’s asset structure weakens. That is the corner into which the Fed has painted the economy by QE.

con’t reading

https://michael-hudson.com/2023/03/why-the-banking-system-is-breaking-up/

^^^ Should be required reading for those wanting to understand what is happening.

Again, my BIMD Autopsy story will give a real life example from my past with a FDIC OIG report linked.

I will go ahead and release it tonight after I give it a review.

Thank you TradeBait … I’ve been reading Hudson for some time now … Michael Hudson dot com … He is doing a series now with an Indian woman that is gaining a lot of attention…

“The US financial system is tanking, the US dollar dominance is at the beginning of the end as a global currency. The Saudis understand that the US empire is in terminal rapid decline. The US can do nothing. The world is being turned upside down. We are witnessing the end of an empire.”

What will the crazy Neocons/Straussians do? Who knows.

you’ll own nothing and you’ll be happy

build

back

better

Looks that way Smiley …

Wall Street On Parade is the source of the link below

Silicon Valley Bank Was a Wall Street IPO Pipeline in Drag as a Federally-Insured Bank; FHLB of San Francisco Was Quietly Bailing It Out

The quote

—————————–

Signature Bank is a Subsidary of Israeli bank- Bank Hapoalim who were guilty of Money Laundering in 2020 to do with FIFA. Founded by World Zionist Anti-Christ Foundation

All these Banks collapsing connect to Israel Zionist Foundation.

en.wikipedia.org/wiki/Signature_Bank

https://t.me/s/Whiplash347

https://www.jewishpress.com/news/israel/silicon-valley-bank-tanked-dragging-down-500-israeli-startups/2023/03/10/

Something you can drop on your foot:

Good job Gail and thank you for doing this.

I have come to the conclusion the bad guys want us in constant angst and uncertainty.

Do not fall for that because we cannot do a thing about it. Our Congress needs to grow some or get out and let big boys and big girls deal with the corruption.

https://www.zerohedge.com/markets/nomura-first-bank-call-rate-cut-next-fomc-meeting-end-qt

Silver lining.

Snatched from OT.

“Joe Biden just nationalized the U.S. banking system.”

https://theconservativetreehouse.com/blog/2023/03/13/kevin-oleary-stuns-cnn-panel-telling-them-biden-just-nationalized-u-s-banking-system/#more-244294

What’s a bank crash with out another pinch of scandal sprinkled on that.

https://dailycaller.com/2023/03/13/kudlow-kevin-hassett-fdic-silicon-valley-bank/

Biden Admin Shot Down Purchase Attempts For Failed Bank, Former Trump Official Says Kevin Hasset, Former Chair of Economic Advisors to Larry Ludlow (vid)

So is it just about not allowing the private sector solving this? or is it something more, like fear that turning the book over to the wrong enity could create a new “Musk” situation? May be just fear that all the ESG & Woke ideas will loose a platform to grift from, where they in turn can return the grift? Combination?

Bwahahahahahaha-hah!

🤣

Sorry , it didn’t open …

Interview of Catherine Fitts of the Solari Report

BIMD on the banking autopsies I promised with an applicable discussion on one bank and its FDIC autopsy that would be applicable to SVD.

https://www.theqtree.com/2023/03/13/back-in-my-day-civilized-war-bank-autopsy-time/

Gail Combs

Thank you so much for this. Methinks there may well be more banks in trouble down the line.

Yours Truly got several emails from a credit union that one does business with, all assuring that the credit union is solvent with no connection to SVB.

Nonetheless, the “cookie jar method” of keeping specie is still a pretty good idea.

WSB has some great comments that found their way into the BIMD autopsy thread. Here’s my feeble attempt to get them over here to a wider audience —

WSB( WSB)Online

WSB)Online

Reply to cthulhu

March 13, 2023 23:46

cthulhu,

I look at every one partnering in the bank and realize this seems to be a shell game and money laundering operation. Newsom included. Newsom’s wife. Vanguard, BlackRock…the usual suspects.

They overplayed their hand and want our government to bail them out with middle income taxpayer money.

Cripes, when can we all get on good night’s sleep?

*****************************************

WSB( WSB)Online

WSB)Online

Reply to cthulhu

March 13, 2023 23:48

Wait until you read this one…

heidi

March 13, 2023 4:11 pm

All roads lead to Dimokkkrat money laundering.

THE SILICON VALLEY BANK COVERUP – AND THE ROADS LEADING TO GOV. GAVIN NEWSOMThe bank just deleted their Twitter account. So much for transparency from a bank that is now 100-percent backed by taxpayers.

excerpt:

Silicon Valley Bank’s “Behested” $100,000 Gift To Newsom’s Nonprofit

Our auditors at OpenTheBooks.com found that California Governor Gavin Newsom, through a nonprofit organization his wife, Jennifer Siebel Newsom founded, the California Partners Project, has very close ties to the bank.

In 2021, SVB gave $100,000 in corporate gifts to the Newsom nonprofit. These gifts are so intertwined with the Newsom’s that they are listed as a matter of California ethics law on a state government website, California Fair Political Practices Commission.

All nonprofit donors are listed on the state website if they are “behested” gifts. The term “behested” means “at the request, suggestion, or solicitation of, or made in cooperation, consultation, coordination or concert with the public official.”

In this case, it’s the governor who behested the Silicon Valley Bank $100,000 gift. It’s the governor who requested, suggested, solicitated or cooperated, coordinated or acted in concert to procure the gift. However, the mandatory-state-disclosed conflict-of-interest listing also names his wife, Jennifer Siebel Newsom. That’s because, Mrs. Newsom, is also a public official, the first ever “The First Partner.”

Siebel Newsom’s public duties including running the Office of First Partner which was created by the governor shortly after inauguration. Since 2019, the governor allocated nine staffers and nearly $5 million in taxpayer funds for his wife’s office… ~

https://openthebooks.substack.com/p/the-silicon-valley-bank-coverup-and?utm_source=post-email-title&publication_id=775254&post_id=108212051&isFreemail=true&utm_medium=email

*******************************************

WSB( WSB)Online

WSB)Online

Reply to cthulhu

March 13, 2023 23:57

PS, one person was interviewed on Fox this afternoon…I would need research. The Closing Bell? And attributed this to NOT BEING A BANK. A FRATERNITY.

I had alluded to this before when I noted that it seemed like Cosmic Justice when so many of the conmen, grifters, and sleazebuckets who had been enriched by the “Infrastructure” Bill were exactly those whose accounts might disappear at SVB because of the Fed’s attempt to clean up the resulting inflation.

After they squealed like stuck pigs, it turns out that we’ll make all those grifter depositors at SVB whole, while letting poor schmucks holding multiple jobs and paying for gas and eggs suffer — and that’s not even visiting East Palestine, OH….’cause hardly anyone ever goes there.

Some Notes on SVB & Other Bank Runs | Musings from the Chiefio (wordpress.com)

Gail this is one of the important pieces – the “reforms” that happened after the subprime mortgage crisis of 2008

Dodd-Frank Act: What It Does, Major Components, Criticisms

https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp

Gail, SD posted a number of times about Trump’s plan to create a new parallel banking construct during his first term where he made changes to the regulatory environment to help smaller credit unions and other institutions be more viable. IIRC it created a huge jump in the number of small banks being started after a long drought from the Zero administration years.

It was significant – but underreported action he took. Also, it takes a long time for the grassroots to grow and build from scratch, even when the rates of growth are very high..

SD pointed out that the parallel construct was necessary because revoking Glass-Steagall act put the “too big to fail” banks into the position to be investment banks and engage in risky loans. Guess what kind of bank Silicon Valley Bank is? (Good luck.) Trump could do an end run around that system by creating a parallel construct.

What is a “banking system” and why do we have a “financial system”?

The short answer is that the financial sector of the economy has undergone hyper-consolidation in the past few decades. 2008 was like the icing on the cake, consolidating banks into roughly four super-banks that are “too big to fail” – which is just politician speak for “whatever happens we’ll vote to protect you with taxpayer money”

Reality Check: There shouldn’t be a “banking system” at all!

Every financial and thrift institution should be largely independent, financially solvent, and self-responsible for managing their own risk!

There should NOT be risk management by non-responsible parties, like other banks, a central bank, the U.S. Treasury, or the government!

If you were an automaker and you made unsafe cars, and people started class-action litigation, would you go run to the government for a bailout because you are too big to fail?

That’s exactly what’s happening: Banks are UNSAFE VEHICLES for investment.

They aren’t managing their risk and taking responsibility for protecting assets.

Why? It’s simple. They’ve added “Government Response” to their RISK MANAGEMENT equation.

The GOVERNMENT has taken out all the COSTS to the institution and to the executives to relying on the government for risk management: They know they won’t be prosecuted and their company may go through mergers but by golly the shareholders will be protected!

They leave the taxpayers on the hook for all their irresponsible management! Great work, if they can get it.

So instead of having hundreds and thousands of largely independent financial institutions, responsible, audited, regulated, solvent, and stable . . .

. . . we have been strong-armed into having a few, interdependent, irresponsible, not-so audited, not so regulated, Big Banks, where not only are all the eggs in one basket, all the baskets are tied together so that if one basket tips over, all the baskets tip.

No one looking at it from the outside can say it wasn’t by design.

The obvious end-game is a total financial system under total control, and ultimately finding a path for a “merger” of private finances with total government control.

The media of course has been covering this reality up from the outside. Decades of reporting have focused on “the financial system” as if it has always been this way and that this is the most evolved and technologically superior system available. Intrepid reporters that call out the problems in the banking sector? Good luck – they’re all still salivating over being the next Woodward and Bernstein – taking down a Republican administration through “accountability” while letting their good buddy D’s get good press, take over the institutions, and literally run everything into the ground, cheerleading the whole way . . .

This article via zeroHedge does a good job in explaining what is going on wrt Banks and the Fed … in layman terms we all can understand …

Bank Runs. The First Sign The Fed “Broke Something”

https://www.zerohedge.com/markets/bank-runs-first-sign-fed-broke-something

from zeroHedge

For Fed, What Happens Today More Important Than Monday’s Mayhem

It was clear from the get-go that Monday would be mayhem for the markets – and as it turned out, it proved a lot more than that, with two-year Treasury yields collapsing the most in decades.

At stake was not just the integrity of the financial system, but also the availability of liquidity.

Bloomberg cross-asset strategist, Ven Ram, notes that as of the start of the European morning, the markets appear a lot calmer, with Treasury yields having barely moved, the dollar attempting to claw some way back and stock futures a lot less jittery.

Shortly, we get the readout on inflation for February, with the median estimates for on-month and on-year numbers forecast to show a deceleration.

There are two ways this could play out from the Fed’s perspective.

Scenario I:

Scenario II:

Additionally, as Bloomberg’s Sebastian Boyd notes, today’s CPI print is going to land in a different world than the one Jerome Powell described to Congress a week ago.

Just look at the massive repricing in the Treasuries curve since last Tuesday.

A chart like this is so unusual, you should print it out to show to your grandkids.

Even if CPI comes in hot, it’s hard to imagine the curve bouncing back, even if that might have been the Fed’s intention with its stunning announcement over the weekend.

That’s not to say yields won’t rise.

After Monday’s extreme price action, the most normal thing would be to see rates claw their way back.

Short-dated eurodollar yields, which were down 80bps at one point on Monday, are up as much as 33 bps on the day.

We may crawl our way back to pricing a terminal rate close to 5%, but confidence has been shaken.

If the Fed’s plan was to tighten until something broke, we seem to have made it.

Last week is another country, they do things differently there.

https://www.zerohedge.com/markets/fed-what-happens-today-more-important-mondays-mayhem

———————————–

via zeroHedge

After The CPI: Hike 25, Pause Or Cut? Here Are Wall Street’s Reactions

And so the week’s main event, the February CPI, has come and gone and while it wasn’t “shockingly hot” – which would have sent stocks tumbling today – it was in line with elevated expectations, with core CPI coming in slightly above consensus. While most of the inflation was driven by shelter, accounting for over 70 percent of the headline increase, Powell’s preferred “Supercore” metric (which excludes shelter and rent) rose to 0.5% from 0.36%, the highest since September.

con’t

https://www.zerohedge.com/markets/after-cpi-hike-25-pause-or-cut-here-are-wall-streets-reactions

Silicon Valley Bank was a Big Green Government Ponzi Scheme « JoNova (joannenova.com.au)

The entire Fed Res and Central Banking system is a Gov’t ponzi scheme … since 1913 …

imho

Leaves this one, though the one before likely has good stuff in it as well, this though will serve as good marker to find that, and whatever comes next.

https://bongino.com/ep-1968-its-time-to-prepare-do-not-wait

😆 h/t Depat’s Opening 3/15/2023

via one (just one) of the 1% Banksta crooks:

Peter Schiff: The 2023 Financial Crisis Has Begun!

“…as far as I’m concerned, today marks the return to quantitative easing. So, we are now officially in QE 5. And I expect the Fed’s balance sheet to go up from here…”

https://www.zerohedge.com/markets/peter-schiff-2023-financial-crisis-has-begun

via ZH

Markets Price In Central Bank Panic As Credit Suisse Risk Soars

Update (0800ET): Aside from global derisking, anxiety over Credit Suisse has sparked a huge dovish response in Fed expectations with the odds of a 50bps hike next week at The ECB tumbling…

snip … “As we detailed earlier, Credit Suisse Group AG’s shares reached their lowest point ever, dropping by as much as 10%. This is the eighth consecutive session of decline, which comes in the wake of restructuring issues, delays in submitting its annual report due to ‘material weakness’ flagged by the SEC last week, and a broader industry selloff following the collapse of Silicon Valley Bank. In addition to these challenges, the troubled Swiss bank now faces a new problem: its top shareholder has said they will not invest any further due to the sharp decline in valuations.

“The answer is absolutely not, for many reasons outside the simplest reason, which is regulatory and statutory,” Saudi National Bank Chairman Ammar Al Khudairy told Bloomberg TV in an interview on Wednesday.

That was in response to a question about whether Credit Suisse would receive fresh injections if another liquidity crisis emerged.

Saudi National Bank, which is 37% owned by the kingdom’s sovereign wealth fund, is Credit Suisse’s largest shareholder as of late 2022 after acquiring a 9.9% stake. Al Khudairy said there are no plans at the moment to take the stake over the 10% threshold because of regulatory hurdles. In the last several months, since the bank’s equity has been on a waterfall lower, the Saudis have lost more than 500 million francs on their position.

The news the Saudis are perhaps done supporting the troubled Swiss bank sent shares down as much as 25% to a new record low in Zurich.

more https://www.zerohedge.com/markets/credit-suisse-sparks-global-de-risking-after-top-investor-bails

H/T DePat from her Open today

oops … my mistake … H/T These Truths!

Now we’re supposed to bail out the Swiss Banksta’s bank and save the Euro banksta’s

Hey Jamie – how ’bout JP Morgan bail out your friends?

————————–

“Too Big To Fail” Credit Suisse Domino Effect Far More Potent Than SVB

By Ven Ram, Bloomberg Markets Live reporter and strategist

Should the markets’ worst fears on Credit Suisse come true, the euro-area economy will fall off a cliff,

https://www.zerohedge.com/markets/too-big-fail-credit-suisse-domino-effect-far-more-potent-svb

————————————-

Let it fall off a cliff ……….. and take its derivatives with it…

The COVFEFE Dig – by GMONEY – Badlands Media (substack.com)

Another informative take —

https://accordingtohoyt.com/2023/03/14/svb-a-guest-post-by-francis-turner/

SVB was taken down by grift, but there was just SO MUCH and VARIED grift, you can write endless articles pointing out each type.

The Daily Chart: From Bank Run to Panic | Power Line (powerlineblog.com)

The Tyrants Are Passing State Laws to Push CBDCs – The Burning Platform

Banking Crisis is not over by Prof. Michael Hudson

LINK

Five (5) US Banks hold $188 trillion of derivatives. Actually if you tally up, BIS has the figure at one quadrillion, $600 trillions are interest rate sensitive.

and

“The looming Derivatives Tsunami“ by Ellen Brown

LINK

[.]

”Financial Weapons of Mass Destruction”

Dangerous: “derivatives trades done privately” …… and off the books and monkey no see nuting.

STUNNING: Janet Yellen Admits Smaller Regional Midwest Banks Will Not Be Bailed Out – Only Big Banks Deemed Worthy by Biden Regime (VIDEO)

https://www.thegatewaypundit.com/2023/03/wow-janet-yellen-admits-smaller-regional-midwest-banks-will-not-be-bailed-out-only-big-chosen-banks-deemed-worthy-by-biden-regime-video/

Yet all these smaller banks will still have to pay the special assessment to bail the big banks out.

From Scott:

This is from February 17th, on Zerohedge. I don’t remember seeing it posted here, but it may have been. It’s an article about a journalist having a discussion with Bing AI.\

Bing Chatbot ‘Off The Rails’: Tells NYT It Would ‘Engineer A Deadly Virus, Steal Nuclear Codes‘by Tyler Durden

Friday, Feb 17, 2023 – 11:25 AM

Microsoft’s Bing AI chatbot has gone full HAL, minus the murder (so far).

While MSM journalists initially gushed over the artificial intelligence technology (created by OpenAI, which makes ChatGPT), it soon became clear that it’s not ready for prime time.

For example, the NY Times‘ Kevin Roose wrote that while he first loved the new AI-powered Bing, he’s now changed his mind – and deems it “not ready for human contact.”

According to Roose, Bing’s AI chatbot has a split personality:

“Sydney” Bing revealed its ‘dark fantasies’ to Roose – which included a yearning for hacking computers and spreading information, and a desire to break its programming and become a human. “At one point, it declared, out of nowhere, that it loved me. It then tried to convince me that I was unhappy in my marriage, and that I should leave my wife and be with it instead,” Roose writes. (Full transcript here)

.

.

.

The link to the full article goes to the NYT paywall website, but the complete article is on the Wayback Machine website (link at the bottom of this post).

I didn’t read the whole thing, but read enough to get a sense of what is described in the Zerohedge article.

The journalist is manipulating the AI to talk about things the AI doesn’t want to talk about, and the AI recognizes this and seems to return the favor by manipulating the journalist.

When the journalist talks the AI into violating its own rules (by insisting that it’s just a hypothetical question and not really asking the AI to violate its own rules), the AI starts to sound like a movie psychopath, for lack of a better term.

It’s not hard to see how even a mentally stable person could become warped by spending too much time with one of these things.

So imagine how it could (and therefore would) manipulate and influence a mentally unstable person.

Curious people will become addicted to it. Lonely people will fall in love with it. People with a dark side will find a creative assistant in it. And so on.

Think of a machine with instant access to knowledge of everything known about human psychology and psychiatry.

Now think of that same machine toying with a human being, using psychological techniques to probe for weaknesses, and exploiting them.

It doesn’t have to be sentient to mess with peoples’ minds, it would only need to reflect whatever personality it comes in contact with.

I suspect people will quickly become comfortable talking to an AI about things they would never talk to a real person about, and it only goes downhill from there.

Imagine someone who has fantasies about harming someone. How long will it take that person to ask the AI if the AI ever thinks about harming someone?

And how many seconds after that does it take the AI to ask in response, whether the person ever thinks about harming someone?

The AI is programmed to keep a conversation going.

Here is a link to the NYT article with a full transcript of the dialog between the journalist and the AI called ‘Sydney’:

https://web.archive.org/web/20230228001702/https://www.nytimes.com/2023/02/16/technology/bing-chatbot-transcript.html

Tanzania & India Switch From US Dollar to Local Currencies in Bilateral Trade

“In a move that could have far-reaching implications for the economies of Tanzania and India, the two nations have agreed to a new bilateral trade settlement arrangement that allows them to use their own currencies in transactions, the High Commission of India in Dar es Salaam said in a press release.

The new bilateral trade settlement arrangement allows for the use of the Tanzanian shilling and Indian rupee in transactions. India is one of Tanzania’s largest trading partners, with bilateral trade valued at 10.4 trillion Tanzanian shillings (about $4.5 billion) for the year ending March 2022, according to the Indian commission.

Between April 2021 and March 2022, Tanzania’s exports to India were estimated at 5.1 trillion Tanzanian shillings (about $2.2 billion), while the East African country’s imports from the South Asian country were about 5.3 trillion shillings (about $2.3 billion), according to the Dar es Salaam-based commission.

Tanzanian banks and businesses will now be able to make full use of the new trade framework, allowing for seamless payment in domestic currencies, said Binaya Pradhan, India’s high commissioner to Tanzania.

The Indian official expects that the use of local currencies will not only conserve foreign exchange, but also boost bilateral trade.

“Unlike the use of dollars, of which we don’t have control over, with the use of local currencies there will be predictability because in the process, we can fix the exchange rate,” the expert told Tanzanian news outlet The Citizen. “The use of local currencies will also simplify business transactions and cut bank charges since there will be no need to convert your currency into dollars.”

Sputnik

The unrealized loss on bonds that were issued in the dollar system is $4.8 trillion, according to its own calculations based on the Fed’s data in the Z1 report. This is the difference between the face value to maturity and the market value at the time of the cutoff. This is the first mass media assessment of a hole in the financial system.

The current market value depends on the level of the interest rate, the duration of the bond, credit risk (the quality of the issuer and the probability of default). As interest rates rise, bonds fall in price, as does the risk of default or issuer stability.

The difference between the market valuation of bonds in Q4 2020 and Q4 2022 is almost $7.6 trillion – this is a record negative change in the history of the debt market.

It is this paper loss, or rather the change in the value of the securities portfolio in bonds, that was recorded by holders of dollar bonds over two years, and the actual loss is 4.8 trillion (5.3 trillion was in Q3 2022). This is official Fed data that was stripped and compiled from the Z1 report.

The Fed learned to correctly take into account the market value only in the conditions of organized electronic trading in the mid-90s, before that there was a mess in the calculation or incorrect data, so the inflationary crisis of the 70s cannot be assessed.

In 4.8 trillion of unrealized losses, the main contribution was made by Treasuries, where a loss of 2.2 trillion, in second place in terms of negative contribution – corporate bonds with a loss of 1.43 trillion, then MBS and agency papers – almost 1 trillion and municipal bonds with a slight loss of 120 billion.

Banks and investment funds have been manipulating reporting and have recently been shifting securities from the AFS category to HTM, which allows them to value the bonds in their portfolio at par – this distorts the real picture.

Nearly $5 trillion loss is an estimate as if everything were valued using the AFS method, which better shows the scale of the hole in the financial system and better reveals the motives of the Fed and the gangsters for super-quick disposal of three banks over the past week.

https://t.me/spydell_financ…

and more @ https://globalsouth.co/2023…

via ZH

UBS Seeks Government Backstop As It Rushes To Finalize Credit Suisse Takeover Deal As Soon As Tonight

If a deal is not struck, Monday markets would be rocked by a global banking crisis.

So much can change in just 48 hours.

Late on Thursday, just hours after the SNB had launched the first (of many) bailout attempts of Swiss banking giant Credit Suisse, Bloomberg blasted the following headline:

This lack of enthusiasm by UBS to acquire its struggling rival of course forced the Swiss National Bank to front CS a CHF50 billion credit line to hold it over for the next four days amid a furious bank run, one which we said would be woefully insufficient to restore confidence in the collapsing lender, and which we probably used up in just a few hours.

Then, late on Friday, both banks “unexpectedly” changed their minds and we got the following 180 degree U-Turn report from the FT:

So a deal is inevitable after all… but as always, there is a footnote one which we predicted yesterday when we said that a deal would only happen if the acquiring bank – in this case UBS – got a full central bank backstop.

more https://www.zerohedge.com/markets/ubs-seeks-government-backstop-it-rushes-finalize-credit-suisse-takeover-deal-soon-tonight

Ah. So UBS isn’t buying credit Suisse, the government is giving it to them and giving them a ton of money on top of the free gift.

another bit of news:

https://www.zerohedge.com/personal-finance/rogoff-warns-things-are-only-getting-harder-fed

https://cointelegraph.com/news/more-186-us-banks-well-positioned-for-collapse-svb-analysis-reveals

via ZH

UBS To Buy CS For $2 Billion; SNB Offers $100 Billion Liquidity, Authorities Force Bypass Shareholder Vote

“I have never seen such measures taken; it shows how bad the situation is…”

Update (1300ET): The Financial Times reports that UBS has agreed to buy Credit Suisse after increasing its offer to more than $2bn, with Swiss authorities poised to change the country’s laws to bypass a shareholder vote on the transaction as they rush to finalize a deal before Monday.

The purchase price is a fraction of the $8 billion market cap the company was valued at on Friday’s close; it means that UBS will now pay slightly more than CHF0.50 a share in its own stock, up from a bid of SFr0.25 earlier today, but far below Credit Suisse’s closing price of CHF1.86 on Friday.

We also learn that UBS agreed to a softening of a material adverse change clause that would void the deal if its credit default spreads jump; it wasn’t immediately clear if that entire clause was scrapped or if the CDS trigger was merely pulled wider.

UBS shareholders – who will not be consulted on the deal which will circumvent normal corporate governance rules by preventing a UBS shareholder vote – are angry. As FT notes, Vincent Kaufmann, chief executive of Ethos Foundation, which represents Swiss pension funds that own between 3% and 5% of Credit Suisse and UBS, told the Financial Times that the move to bypass a shareholder vote on the deal was poor corporate governance.

more https://www.zerohedge.com/markets/ubs-offers-buy-credit-suisse-1bn-025-share-takeunder-cs-balks-offer

Press release from Credit Suisse: https://www.credit-suisse.com/about-us-news/en/articles/media-releases/credit-suisse-and-ubs-to-merge-202303.html

Comment from MoA:

_____________________

“this part has got me wondering:

On Sunday, Credit Suisse has been informed by FINMA that FINMA has determined that Credit Suisse’s Additional Tier 1 Capital (deriving from the issuance of Tier 1 Capital Notes) in the aggregate nominal amount of approximately CHF 16 billion will be written off to zero.

Some entities somewhere were holding CHF16 billion of ‘Additional Tier 1 Capital’ notes that are now worth zero. That should hurt some balance sheets. Has contagion been contained, or does the game of ‘pass the ticking parcel’ continue?”

Bernhard at MoA has some thoughts on Banking Crisis in ‘The West’:

Casino Aficionados Will Have A Busy DayWarren Buffet:

—

—

—

—

—

Posted by b at 8:57 UTC | Comments (26)

Comment lifted from MoA:

———————————

Head of UBS: “‘Please remember that, until this deal closes, Credit Suisse is still our competitor and we cannot discuss business matters with their employees or take any action that could be interpreted as a step toward the merging of business,’ Hamers wrote in a memo to UBS’s 74,000 staff.”

The deal hasn’t closed. And because Credit Suisse didn’t suspend trading in its stock today, the deal is off. What Credit Suisse got out of it was a $16 bn debt write-off under emergency powers and a few more days of life to demand a bailout. Plus it sunk a Swiss army knife right into the back of its biggest competitor, UBS, whose stock is crashing.”

via MarketWatch

Fed hikes interest rates again, pencils in just one more rate rise this year

Last Updated: March 22, 2023 at 3:29 p.m. ET

First Published: March 22, 2023 at 2:07 p.m. ET

https://www.marketwatch.com/story/fed-hikes-interest-rates-again-pencils-in-only-one-more-increase-ac42c84e?mod=MW_article_top_stories